Here are the most recent and most important market charts and analysis for today!

EURTRY

The pair was caught between the MAs 50 and 200, but was expected to defy the “Death Cross” and will continue to go up in the following days. The accession of Turkey in the European Union created a lot of issues with the EU’s member states as they are looking for an agenda with President Recep Tayyip Erdoğan plan to join the bloc. Turkey was a gateway to the East and the West, an important military strategic location. However, in the recent months Turkey was seen to accept more refugees, a requirement given by the European Union to Turkey before it could join the bloc. Analysts see these as being submissive to the European Union. Turkey was also part of the NATO (North Atlantic Treaty Organization), and would be an important geopolitical region for the planned EU militarization. Histogram and EMAs 13 and 21 was expected to continue to go up.

GBPAUD

The pair was seen to bounce back after finding support from MA 200. Both the United Kingdom and Australia were facing an event that will eventually shape the future of the two countries. UK Prime Minister Theresa May was still struggling on how she will be able to pass the deal she negotiated with the European Union to the UK Parliament, after the deal was accused to benefit the EU more that it benefits her country. Despite this struggle, analysts still expect that the UK will eventually surpass France’s economy by 2023 to become the Europe’s biggest economy. The talks of secession with Scotland and Northern Ireland increases the possibility of integrating the CANZUK (Canada-Australia-New Zealand-UnitedKingdom), countries that consider Queen Elizabeth II as their Head of State. Meanwhile, Australia will face Australian Federal Election on or before May 18, 2019. Histogram and EMAs 13 and 21 was expected to reverse.

GBPCAD

The pair was expected to reverse in the following days as the impending “Golden Cross” looms. Canada and Australia were still trading inside a channel as investors and traders are waiting for the next move that each country will make. The United Kingdom was facing a “No Deal Brexit”, which was the worse deal that the UK could have. A “No Deal Brexit” was widely expected by analysts to trigger a recession within the European Union, particularly the United Kingdom. Canada on the other hand, was caught in the middle of economics-turned-political war between the United States and China. As the behavior of Trump becomes less predictable, Canada was worried that the US might pull out of the “current” NAFTA (North American Free Trade Agreement). It was supposed to pivot to China to make bilateral trade agreement, but was immediately scrapped after Canada arrested Huawei’s No.2 due to increasing pressure from the United States. Histogram and EMAs 13 and 21 was expected to reverse.

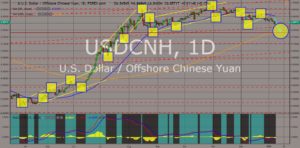

USDCNH

The pair will continue to go lower in the following days after it broke out of the “Rising Wedge” pattern. The 90-day truce in the trade war between the United States and China was now on its 38th day, with the truce set to expire on March 01, 2019. Despite Chinese state media’s warning the United States not to demand too much from China, and the United States stepping up its effort to pressure with Canada to ban Chinese technology company, Huawei, the relationship was seen by analysts to be more stable due to the fresh talks between low level diplomats from each country. After the talks between the two countries, China decided to approve the import of five genetically modified crops amid pressure from the United States to open up its market to more farm goods. Histogram and EMAs 13 and 21 was expected to continue its fall.

COMMENTS