Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

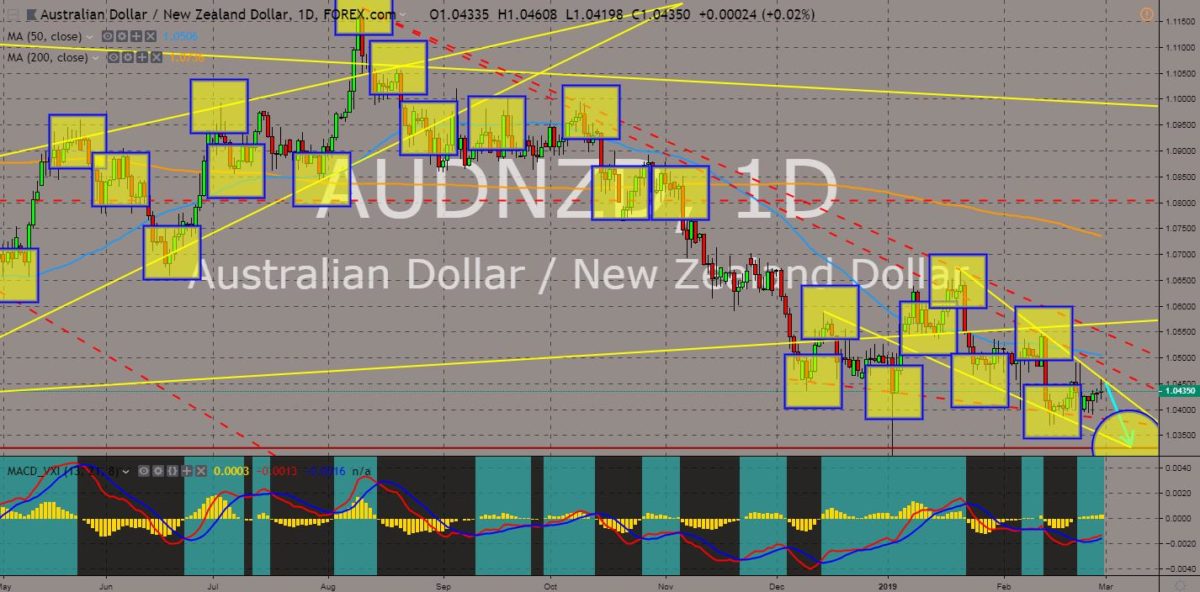

AUDNZD

The pair was expected to further go lower to complete the “Falling Wedge” pattern. Last week, Australian Prime Minister Scott Morrison visited New Zealand to talk with Prime Minister Jacinda Ardern about the rising threat of China from its militarization of the South China Sea to the trades and Intellectual Property theft of its telecommunication network Huawei. However, the visit also prompted the growing issue of division between Australia and New Zealand. PM Jacinda attacks Australian deportation policy after Australia deported criminals originating from New Zealand knowing the fact that these criminals didn’t set foot to New Zealand since they were born. Australia said it has every right to send criminals back to New Zealand. PM Jacinda Ardern received admiration as the first president to give birth while holding her position, and for making New Zealand neutral. Histogram and EMAs 13 and 21 was expected to fall lower.

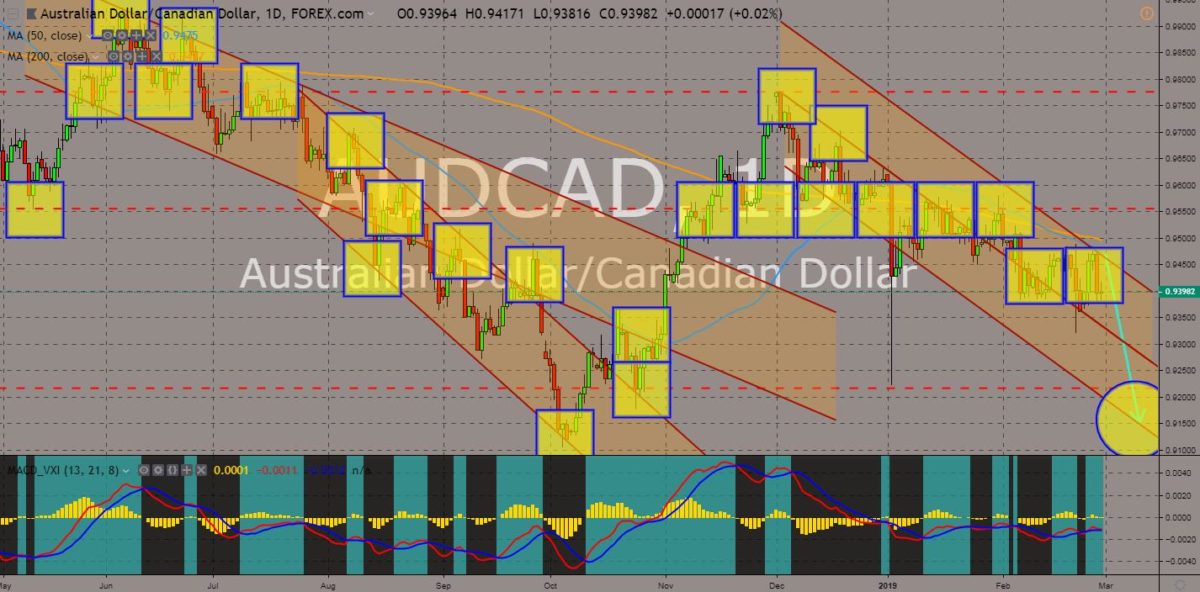

AUDCAD

The pair failed to break out of the down trend resistance line, sending the pair lower to its support line. Canada had suffered from the trade war between the United States and China. US President Donald Trump pressured the country ban the Chinese technology company Huawei amid security concerns, as part of the intelligence alliance known as the Five Eyes Intelligence Alliance. Canada was the only member who didn’t ban the company but was pressured by the US to arrest Huawei Global Chief Finance Officer as part of Canada’s extradition treaty with the United States. Australia on the other hand, managed to offset the pressure by the United States by being the leader of the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), which boost cooperation among its Asian members and counter Trump’s trade war. Histogram and EMAs 13 and 21 will enter to a selling pressure in the following days.

AUDCHF

The 50 MA acts as the pair’s support line, with the pair seen to bounce back following the impending “Golden Cross”. Australia overtake Switzerland to lead the world in median wealth stakes, grabbing the title “Switzerland of Asia” from Singapore. Australia hadn’t had any recession in the past 30 years, which signals a strong economy. On the other hand, Switzerland was pressured by the European Union to sign a framework deal that incorporates a series of bilateral agreements that it has with the EU. Switzerland is not a member of the European Union but has an access with EU’s Single Market and Customs Union through bilateral agreements. Switzerland challenged Australia to hack its e-voting system as Australia face an impending federal election on May, which can change Australia’s faith in the future. Histogram and EMAs 13 and 21 was expected to reverse in the following days.

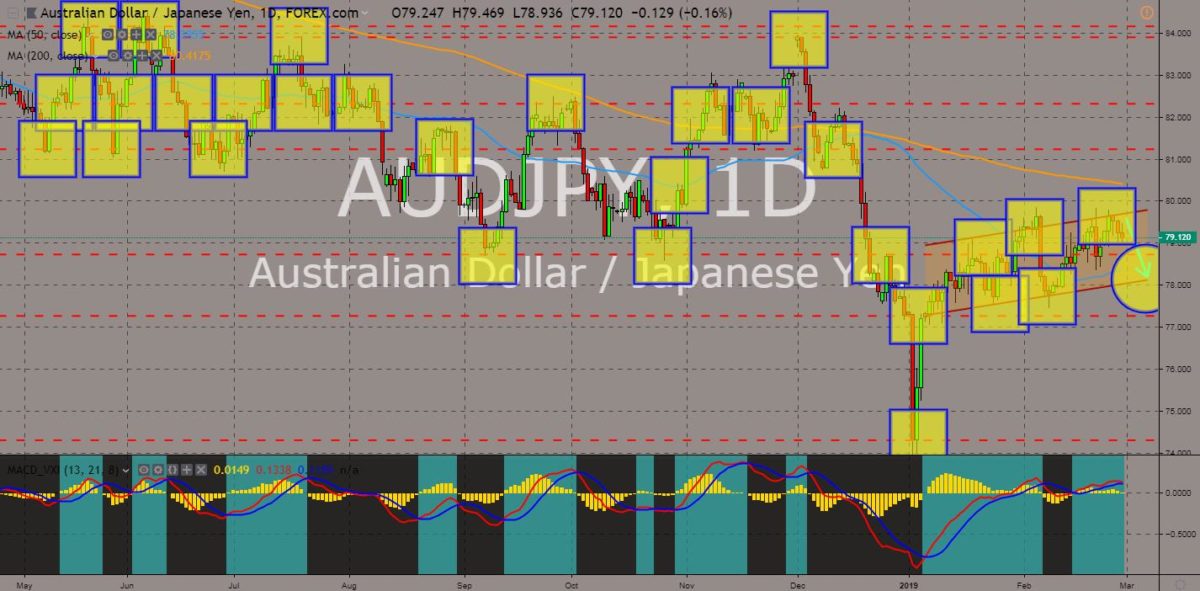

AUDJPY

The pair will continue its downward movement towards the channel resistance line. Australia and Japan were two (2) regional powers in the Asia Pacific. They will both lead the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). However, both these countries were competitors when it comes to trade. The two (2) countries are competing to be the largest exporter of agricultural products. The competition further extends with the divorce between the United Kingdom and the United States to which the EU ratified its trading agreement with Japan, which created the largest trading zone in the world. While the United Kingdom signed a post-Brexit trading agreement with Australia, which was UK’s former colony. However, the growing gap between Australia and its neighbor New Zealand will impact their strategic alliance. Histogram and EMAs 13 and 21 was seen to further go lower.

COMMENTS