Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

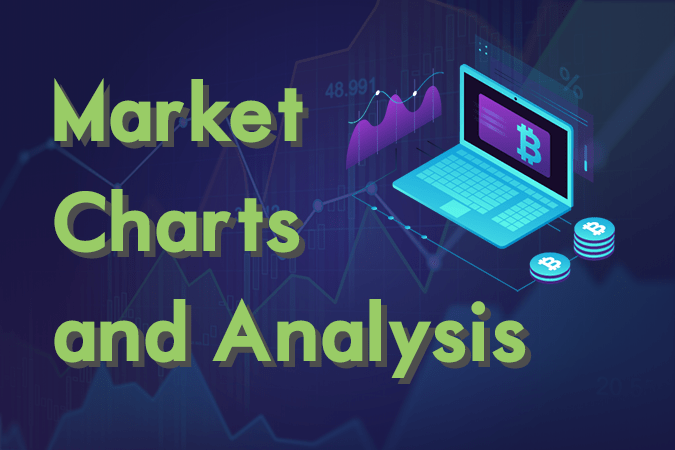

NZDJPY

The pair was seen to break down from a major support line and to continue its steep decline, sending the pair lower to its nearest support line. With the fallout of Australia, with the country experiencing recession (based on GDP per capita) for the first time in twenty-seven (27) years, New Zealand was seen taking its place as a regional power. New Zealand had successfully signed a post-Brexit trading agreement with the United Kingdom, while maintaining its existing trade relation with the European Union. Another regional power in the Asia Pacific, Japan, had also ratified the EU-Japan Free Trade Deal, which became the largest trading zone in the world. Japan and Australia both headed the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). With the uprising of New Zealand as a regional power, it puts the country in direct competition with Japan. Histogram and EMAs 13 and 21 will continue to fall.

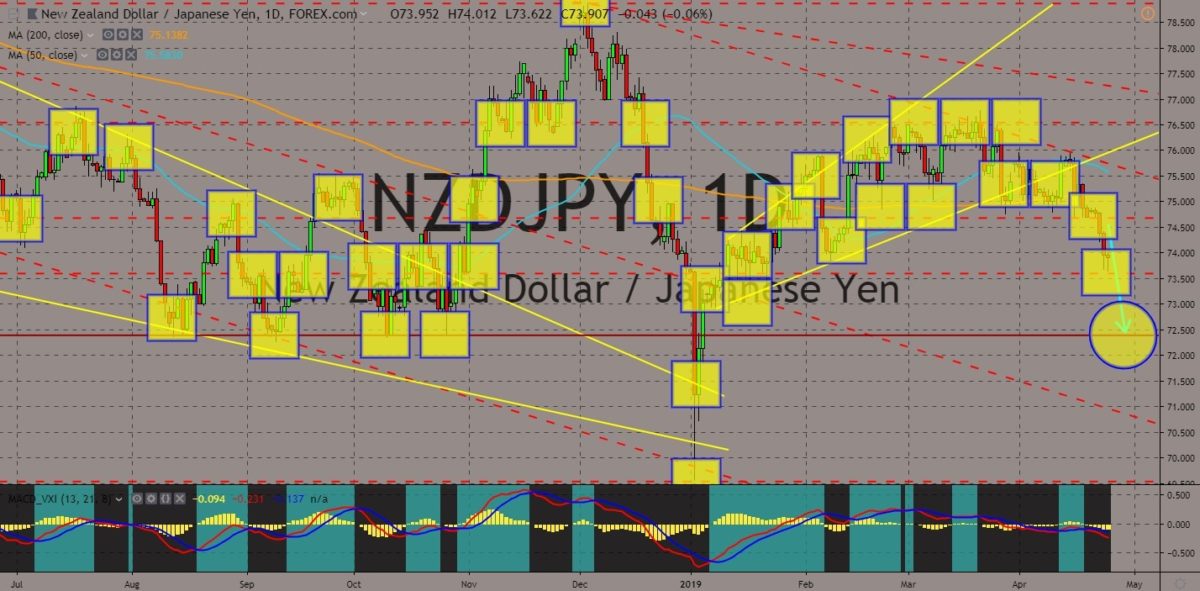

NZDUSD

The pair is expected to bounce back after a solid bullish candle ended the steep decline of the pair. The trade war between the United States and China had escalated from economics to politics after US President Donald Trump had called his allies to ban the Chinese technology company Huawei amid security concern. Only Canada among the Five Eyes Intelligence Alliance didn’t ban the company. However, in just a few months, the United Kingdom and New Zealand had pulled their statement regarding Huawei paving way for a possibility that the two (2) countries will tap the company to build their Fifth Generation (5G) Network. Now, the UK confirmed that it will use Huawei gear into parts of its 5G infrastructure, increasing pressure to New Zealand. However, the visit of New Zealand Prime Minister Jacinda Ardern to China will defy President Trump. Histogram and EMAs 12 and 21 will reverse in the following days.

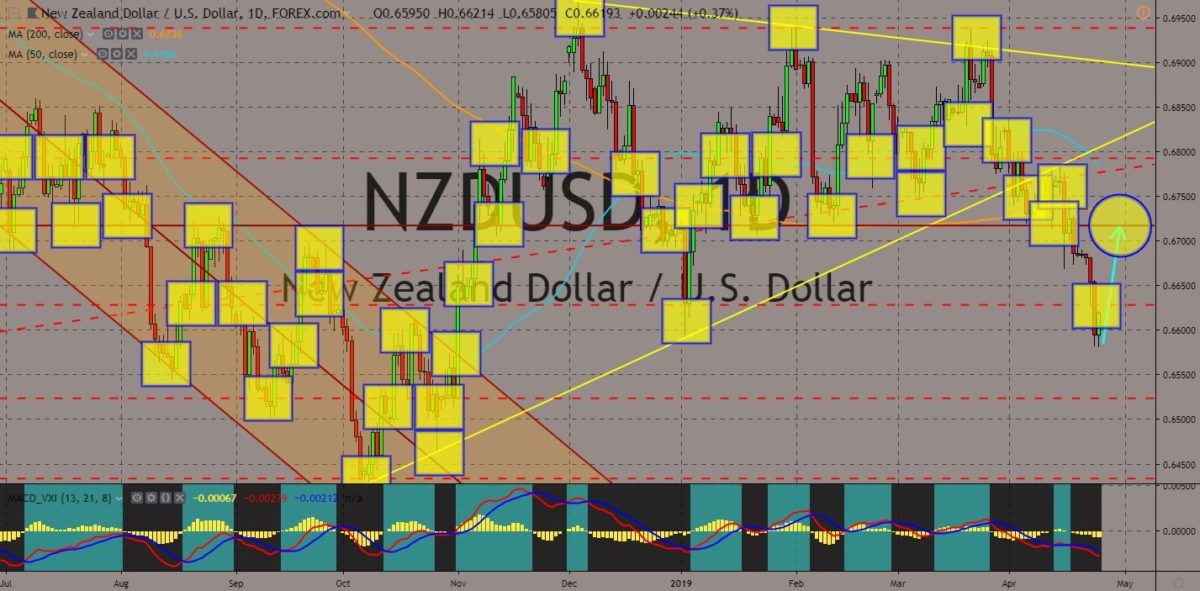

NZDCAD

The pair was seen consolidating from the “Descending Triangle” pattern extended support line, which signals a bounce back from the pair. New Zealand appears the weakest among the CANZUK (Canada-Australia-New Zealand-United Kingdom) until in the recent months where the country’s foreign policy shifted from being Australia’s shadow to being neutral with international issues. New Zealand strike a post-Brexit trading agreement with the United Kingdom, while it maintains its trading relation with the European Union. Australia tried the same approach but had received tariff quotas from the EU. New Zealand was also the only country to abstain from taking sides in the Venezuelan crisis. On the other hand, Canada was now losing its limelight after its disputes with the Kingdom of Saudi Arabia and China. Histogram and EMAs 13 and 21 was expected to crossover in the following days.

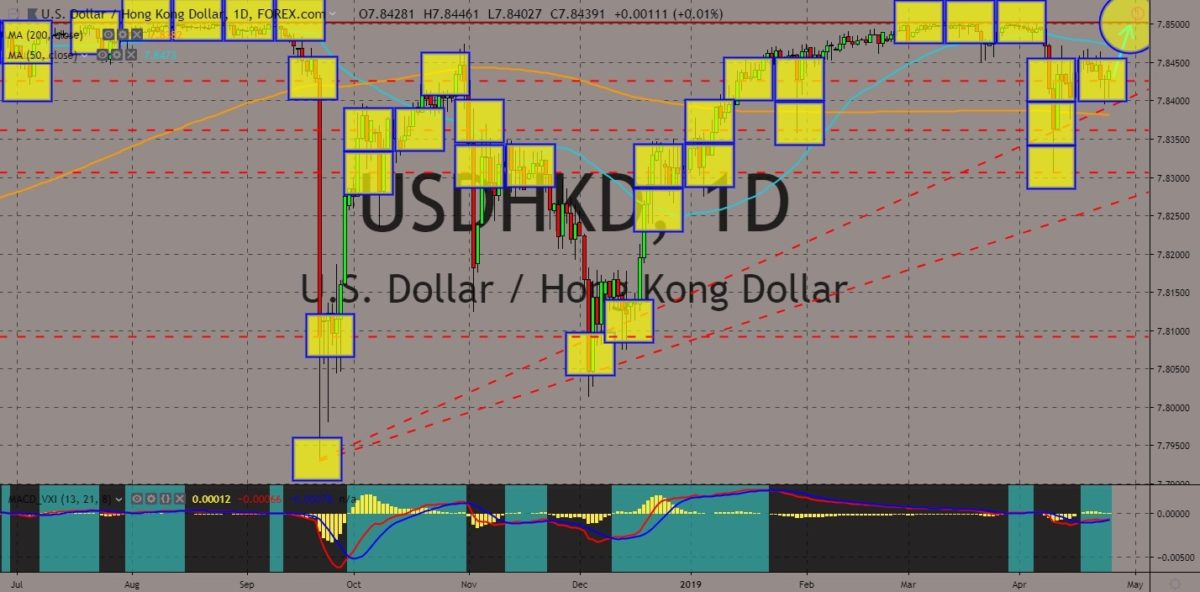

USDHKD

The pair was seen consolidating on a major support line, which could send the pair higher and reach an all-time high. Since the Hong Kong Policy Act was passed in 1992, the United States had been checking if China is keeping up to its commitment to grant Hing Kong a greater autonomy under the policy of “once country, two systems,” enshrined in the Sino-British Joint Declaration and the Hong Kong Basic Law. The handover of Hong Kong to China also marked the end of the British Empire. However, UK Foreign Secretary Jeremy Hunt said that the jailing of four (4) leaders of Hong Kong’s 2014 pro-democracy protests was deeply disappointing. The return of independence of the United Kingdom from the European Union might also signal a strengthening relationship between the UK and the United States to contain China and maintain the “one country, two systems policy”. Histogram and EMAs 13 and 21 will go up.

COMMENTS