Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

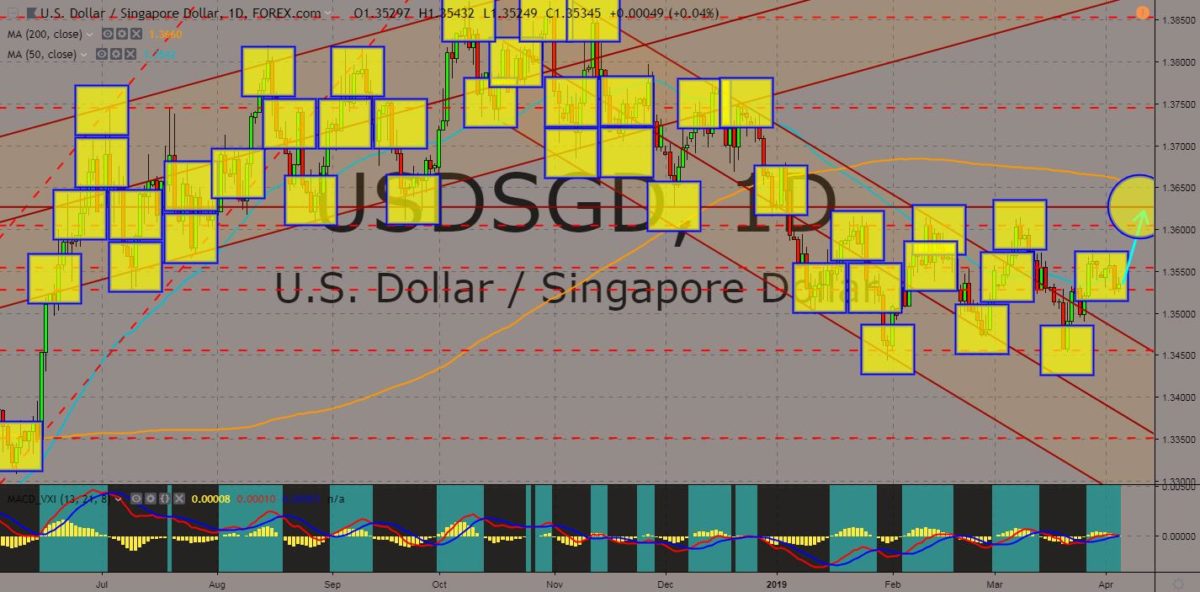

USDSGD

The pair managed to breakout from the downtrend channel resistance line for the second time and was expected to retest a major resistance line. The United States was trying to gain influence on major shipping routes, Singapore and Thailand, to contain China’s aggressive expansion in Asia, particularly through China’s Belt and Road Initiative. Experts warned of China’s debt diplomacy wherein China was giving grants and loans that are excessive to a country’s capacity to pay. This was what happened with Sri Lanka’s biggest port, whom China was now controlling under a 99-year lease after the government defaulted on its debt. The port will give China a strategic capacity to flex its military muscle in the Indian Ocean. The nearest rout from China to Sri Lanka is the Singapore Strait, which was the main reason why US wants to be friend with the tiny Asian country. Histogram and EMAs 13 and 21 was seen to fail to reverse.

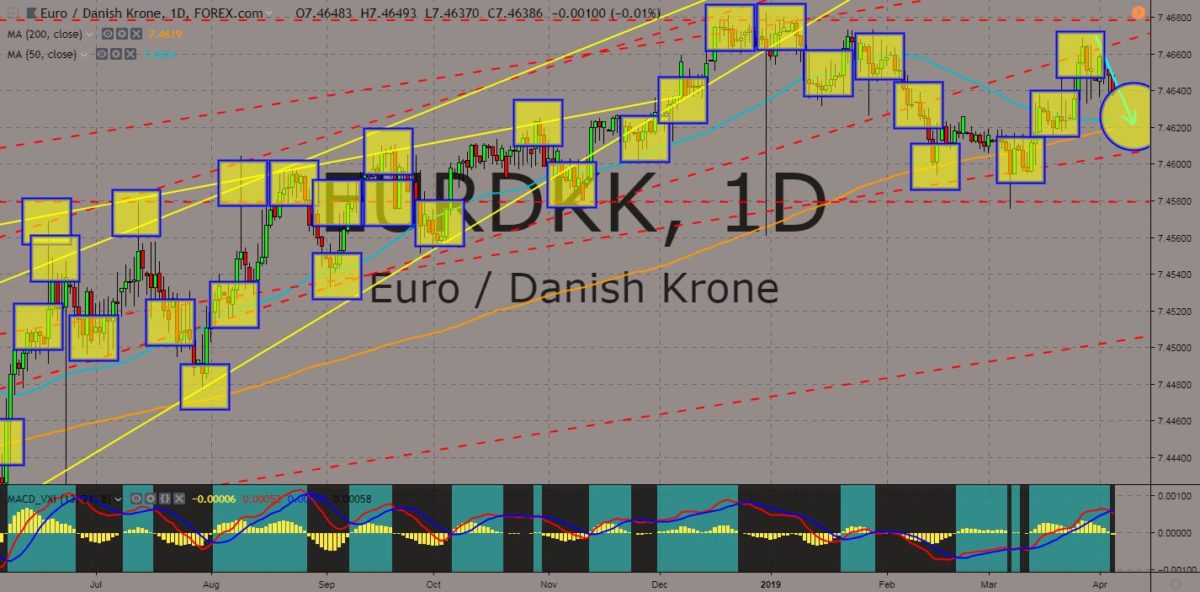

EURDKK

The pair failed to breakout from an uptrend resistance line, sending the pair lower to MAs 50 and 200, with a possibility of a cross over that will result to a “Death Cross”. Denmark replaced the United Kingdom’s role in the European Union and had share a power balance with Germany and France. This scenario was first seen by investors and experts as a positive momentum for a Germano-Franco alliance. However, as time goes by, Denmark was seen to be accosting the EU’s decisions. The Danish left-wing, the Red-Green Alliance, changed their stance of EU membership referendum as poll suggest that Denmark was the most satisfied country in the EU. This will further boost Denmark’s influence in shaping the future of the bloc. Denmark will be the only EU member, after the UK officially leaves the EU, that can choose not to participate in not using a Euro currency. Histogram and EMAs 13 and 21 already crossed over.

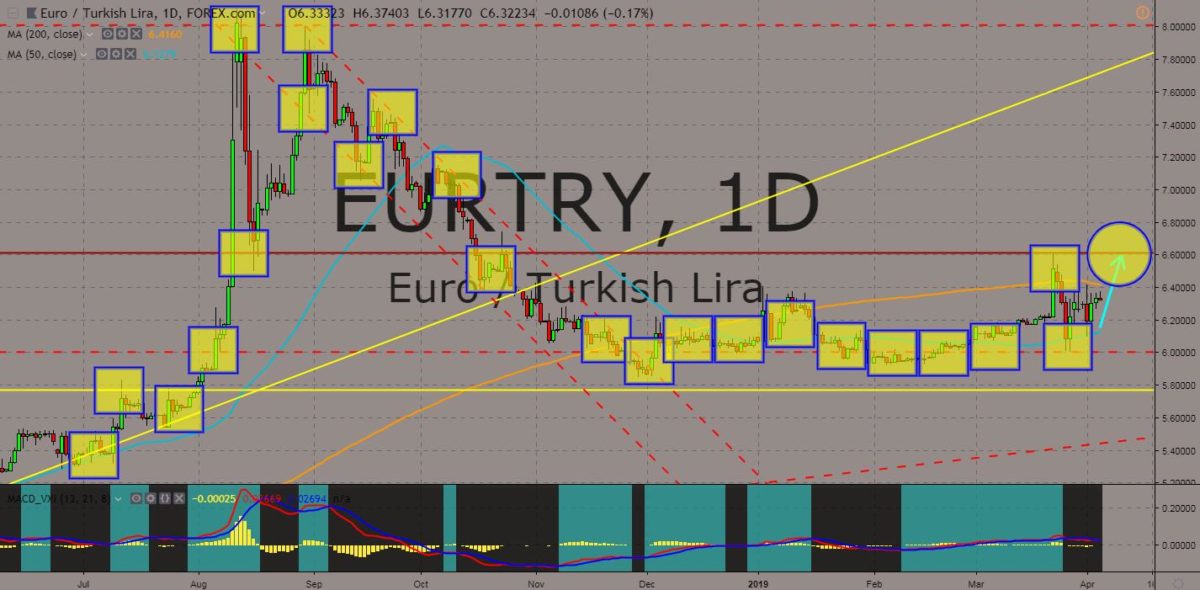

EURTRY

The pair was trading inside MAs 50 and 200 and was expected to breakout from 200 MA to retest its previous high. The Turkish Election held last March 31 showed that Turkish President Recep Tayyip Erdogan’s party lost control over Ankara, Turkey’s political center, and Istanbul, Turkey’s commercial center, Erdogan’s home city, and his longstanding core of support. This was after the European Parliament held a non-binding vote to suspend Turkey’s accession in the European Union. Turkey was already part of the EU’s Customs Union but will need to join the Single Market to complete its EU accession. It also loses the United States support, particularly the US led NATO (North Atlantic Treaty Organization) Alliance after it choose Russia’s S-400 Ballistic Missile Defense System rather than US’ THAAD (Terminal High Altitude Area Defense). Histogram and EMAs 13 and 21 was expected to go up in the following days.

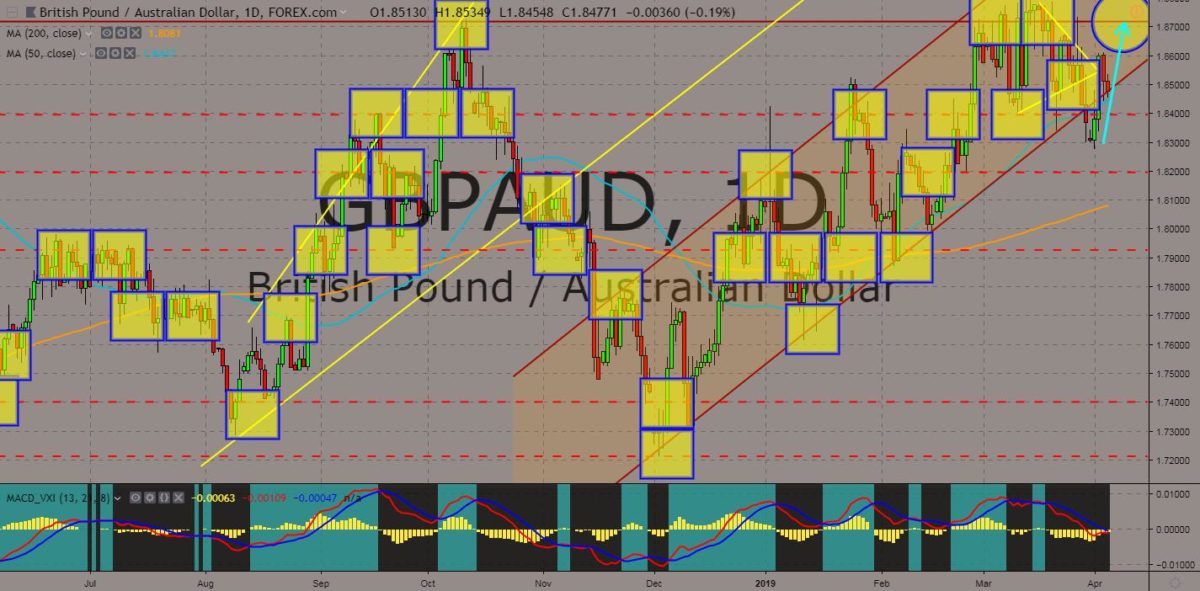

GBPAUD

The pair managed to get back from the uptrend channel after it broke down from the support line following another break down from the “Pendant Formation”. Australia was one of the countries that took advantage from the political turmoil in Europe after the United Kingdom decided to leave the European Union through the post-Brexit trading agreement. However, the extension of the Brexit puts more uncertainty over the future of the UK and a bigger possibility of a “No Deal Brexit” scenario. The uncertainty will further hurt Australia’s embattled economy as the country entered its first recession in thirty (30) years. Australia will also face an impending Federal Election, which also adds to uncertainty to Australia’s future. The United Kingdom was given an extension until March 12 by the European Union to prevent the country from crashing out of the EU without a deal. Histogram and EMAs 13 and 21 was expected to go up.

COMMENTS