Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

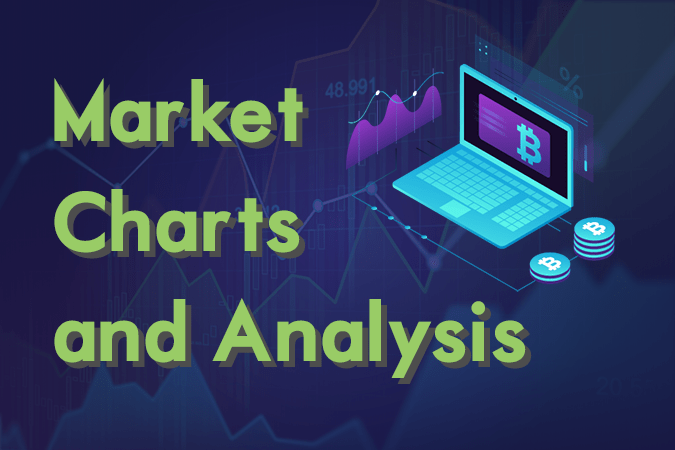

AUDJPY

The pair will continue its steep decline and to break down from the downtrend channel middle support line. Japan and Australia both headed the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), representing the two (2) largest economies in Asia Pacific. However, it will be no coincidence if the two (2) countries will try to dominate the pact, which will give them a huge influence in shaping the future of the pact, which can largely benefit their country. The division between the two (2) countries was further widen by the withdrawal of the United Kingdom from the European Union, which had forced their allied countries to take sides between them. Australia signed a post-Brexit trading agreement, while Japan ratified the EU-Japan Free Trade Deal, which became the largest trading zone in the world. Histogram and EMAs 13 and 21 will continue their downward movement.

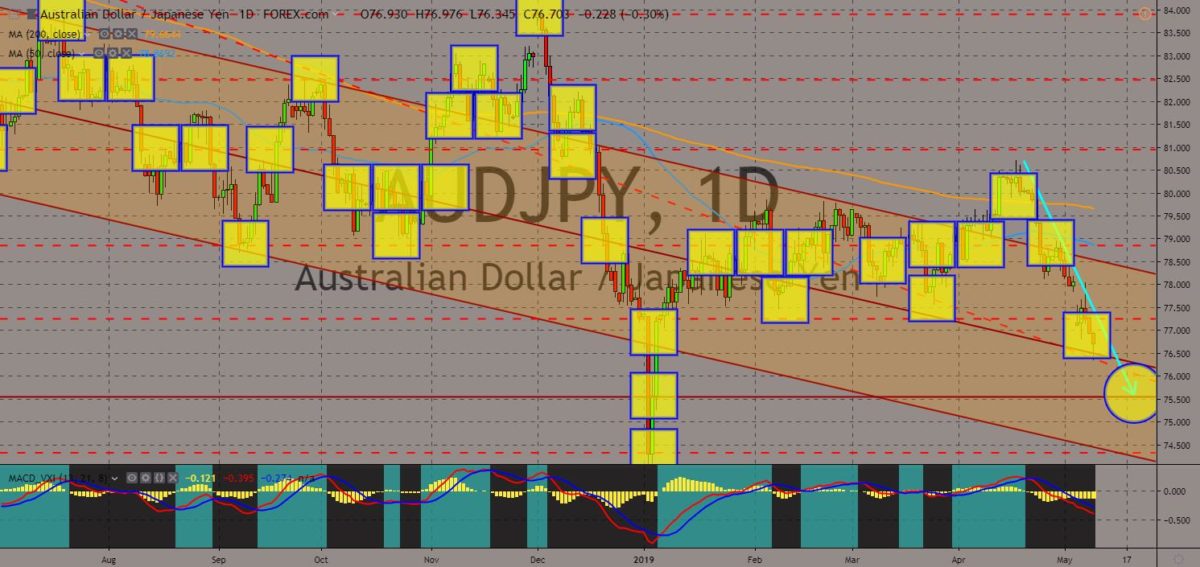

AUDUSD

The pair failed to climb back to its previous support line, sending the pair lower towards the nearest support. With the current situation in Australia, this will be the right time for the country to further deepen its ties with the United States. The US and Australia were the only remaining countries among the Five Eyes Intelligence Alliance that was still banning the Chinese technology giant Huawei amid security concern. The country faces pressure as it enters a recession (based on GDP per capita) for the first time in 27 years, followed by the looming federal election. The United States will also need Australia to secure the Indo Pacific routes after China was given the right to lease the biggest port in Sri Lanka, which can host military base in the Indian Ocean and further expand China’s military after the United States loses its presence in the Indian Ocean. Histogram and EMAs 13 and 21 will fail to crossover.

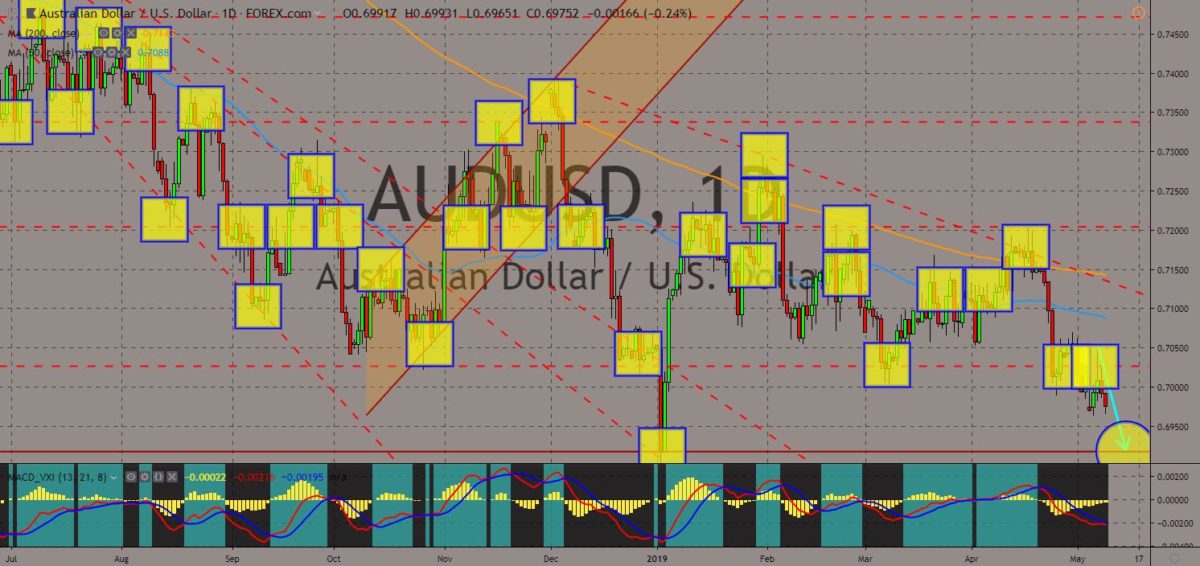

AUDCAD

The pair will continue its steep decline following the looming crossover between MAs 50 and 200, which will form a “Death Cross” formation. Australia and Canada were former colonies under the British Empire, together with New Zealand. The two (2) countries were world apart with Canada located at the West and at the top-most region, while Australia is in the East and was located below the map. The gap between the two countries were further narrowed with Australia signing a post-Brexit trade agreement with the United Kingdom, while Canada joined the Germano-Franco led “alliance of multilateralism” together with Japan and had received a green light from the European Parliament to conduct a bilateral trade agreement with the European Union. The ratified EU-Japan Free Trade Deal became the largest trading zone in the world. Histogram and EMAs 13 and 21 was seen to fail to crossover.

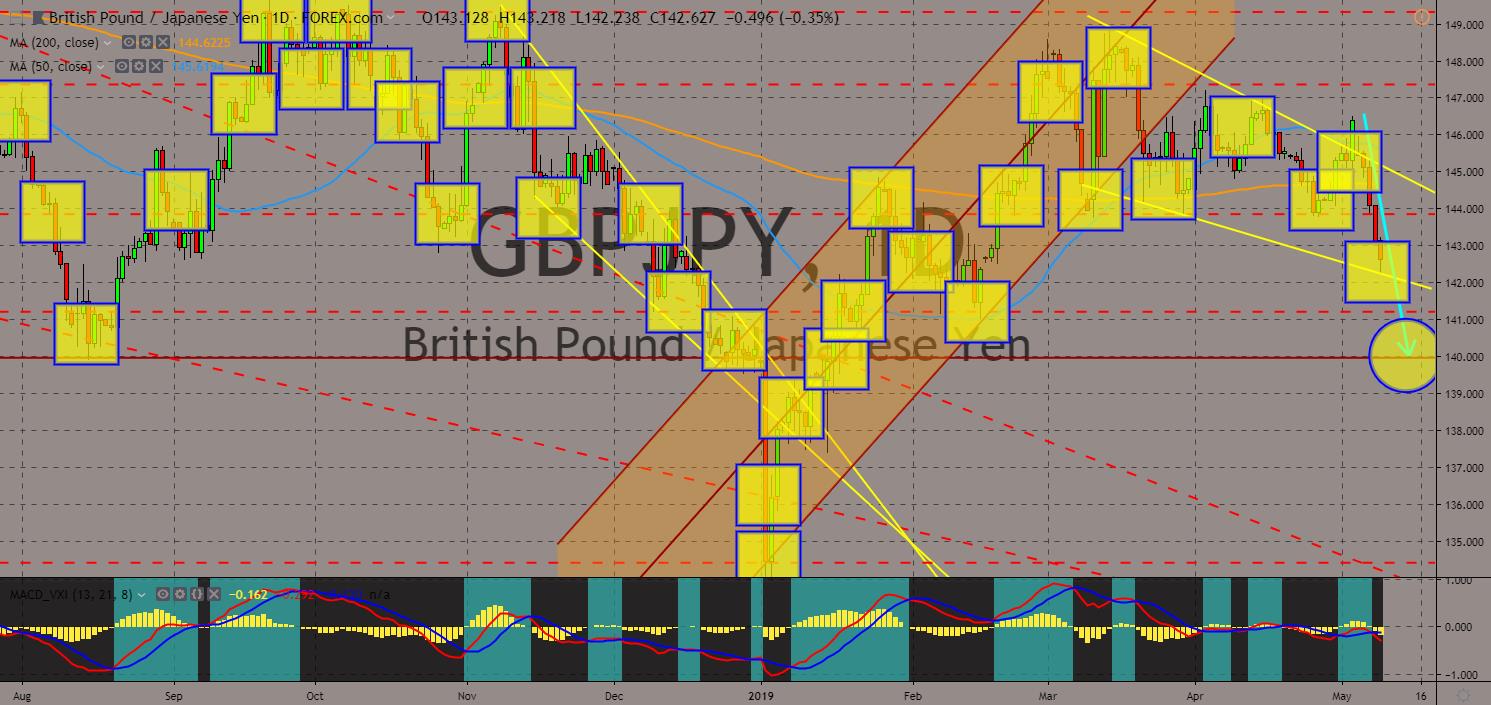

GBPJPY

The pair will continue to fall lower in the following days and to break out from the “Falling Wedge” support line. The extension and uncertainty surrounding the Brexit causes the relationship between the United Kingdom and Japan to fall. The ratification of the EU-Japan Free Trade Deal also adds risk to the relationship between the two (2) countries. Some Japanese firms had already pulled out from the UK and had established businesses in the European Union amid uncertainty on the British economy. It was estimated that the divorce between the EU and the United Kingdom will cost at least $10 Billion, aside from other cost that might arise due to uncertainty. Aside from this, Japan had joined Canada to the Germano-Franco led “alliance of multilateralism”, which aims to prevent protectionist countries from derailing the global order. Histogram and EMAs 13 and 21 recently crossed over.

COMMENTS