Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

NZDJPY

The pair will continue falling down in the following days with the impending cross over between MAs 50 and 200. Japan is at the center of attention this year as it successfully avoided the trade war between the United States and China that had caused emerging and East Asian countries to fall. The country had ratified the EU-Japan Free Trade Deal, which became the largest trading zone in the world. Japan was also planning for the reinterpretation of the Article 9 of the Japanese constitution, which prohibits the country from building military equipment that can be use for war. Japan had also entered a new era of Reiwa (peaceful harmony) with the abdication of the Emperor Emeritus Akihito. Japanese Prime Minister Shinzo Abe has also a strong hold on the Japanese government, making him one of the longest serving PM in Japanese history. Histogram and EMAs 13 and 21 was expected to have a narrower gap.

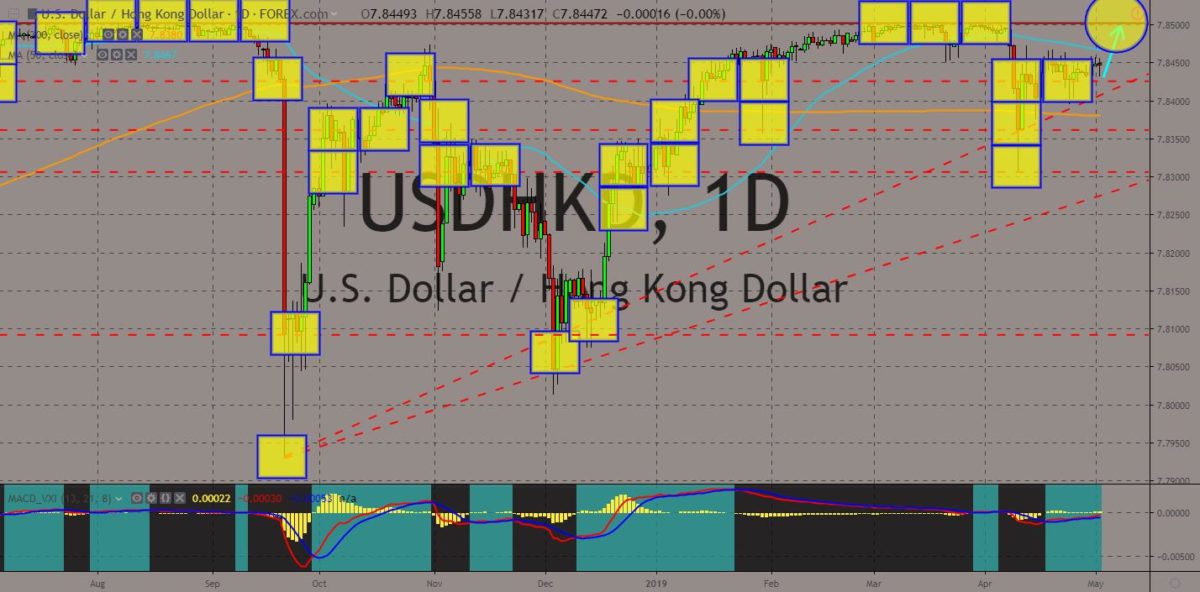

USDHKD

The pair was expected to breakout from MA 50 before revisiting its previous highs, which might push the pair higher towards an all-time high. Hong Kong became the pawn of China against the United States, particularly in defying the US sanction against Iran and North Korea. The United States had ordered three (3) Chinese banks that wholly or partially owned Hong Kong firms dealing with North Korea. The involvement of Hong Kong shadow firms had also become the basis for the United States to order arrest of the Chinese telecommunication giant Huawei’s Global Chief Finance Officer Wang Meng Zhou in Canada as part of their extradition treaty. The arrest was done on the same time US President Donald Trump and Chinese President Xi Jinping agreed to a 90-day trade truce during their sideline meeting during the G20 Leaders Summit. Histogram and EMAs 13 and 21 will continue to go up in the following days.

USDSGD

The pair was seen to bounce back from the downtrend channel middle support line after it failed to break out from the 200 MA. The United States was strengthening its military relationship with Singapore through the annual bilateral drill, which aimed at protecting the Singapore strait, which was the nearest route through the South China Sea and the Indian Ocean. In 2018, China was able to seize the largest shipping port in Sri Lanka after it defaulted in its Chinese debts, giving China the access to the Indian Ocean. It was also reported that Singapore was planning to buy US F-35 fighter jets, which will leverage the US against China. In March, Singapore, the United States, and Thailand celebrated the 25th year of its annual trilateral exercise Cope Tiger. Now, the US and Singapore is currently holding the Valiant Mark exercise. Histogram and EMAs 13 and 21 was expected to fail on its looming crossover.

EURDKK

The pair failed to break out from a major resistance line, sending the pair lower towards the nearest support line. In the poll conducted, Denmark was the most satisfied country with its membership in the European Union among the 28 members of the bloc. This had made the country a viable replacement of the United Kingdom in the trilateral power balance together with Germany and France. Denmark was the UK’s closest friend inside the EU, which can be a key to have a smoother Brexit deal. Germany’s reliance to Russia’s natural gas had made Denmark to propose of using US’ Exxon Mobil rather than Russia’s Nord Stream 2. The country was also an ally to the United States, which can disrupt the dream of a Germano-Franco Alliance led European Union. Aside from this, the EU’s far-right parties united to create a coalition ahead of the European Parliament election. Histogram and EMAs 13 and 21 was expected to fall.

COMMENTS