Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

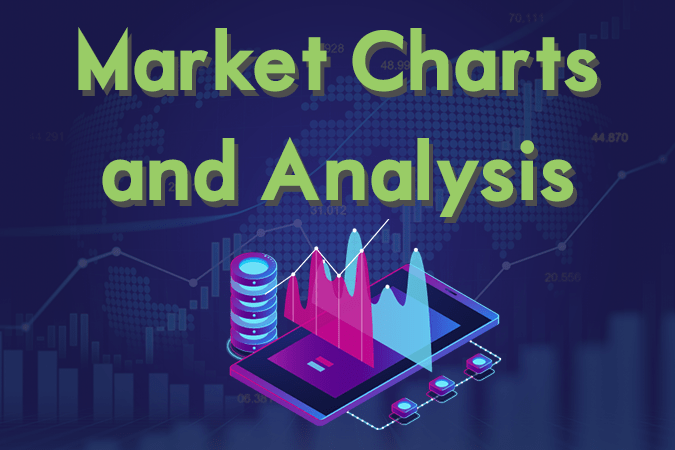

EURTRY

The pair was projected to further go up in the following days with the recent crossover between MAs 50 and 200. Turkish President Recep Tayyip Erdogan urged the European Union to make decision on Turkey’s bid for accession inside the bloc after the European Parliament voted to hold Turkey’s accession to the EU in a non-binding vote, citing violations on human rights. For the first time, Slovak Republic of the Eastern and Nationalist bloc, the Visegrad Group, speak up about EU Parliament’s politically motivated stance with Turkey. Aside from this, a trouble was brewing at home with two (2) senior officials of the ruling AKP Party of President Erdogan are attempting to form new parties after criticizing the APK Party. The APK Party loses during the recent election. Histogram and EMAs 13 and 21 will continue going up.

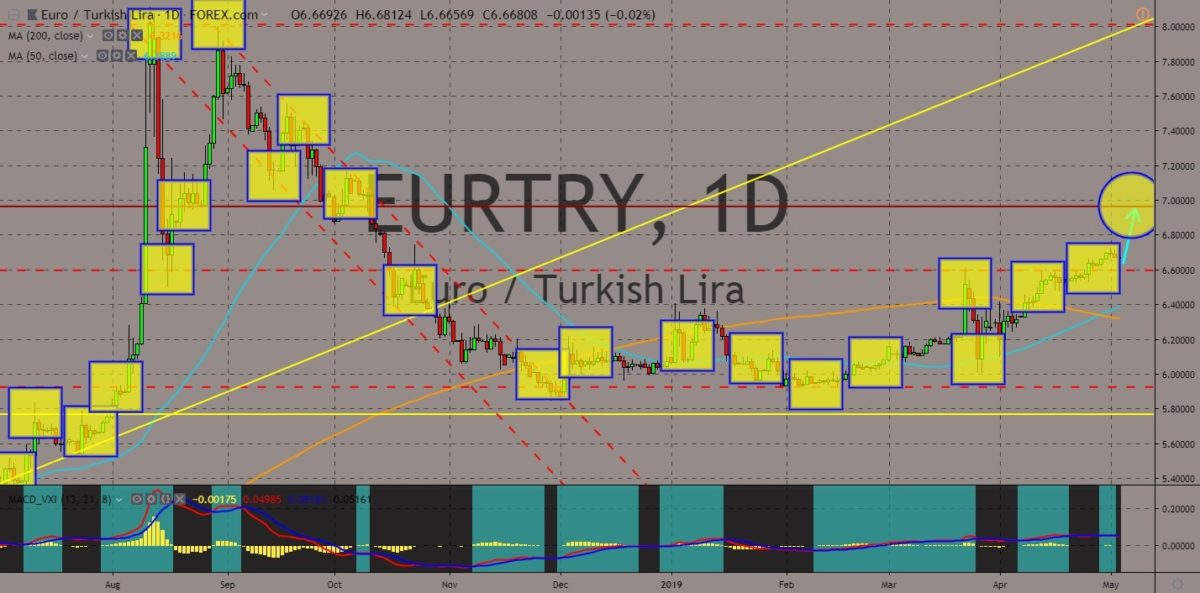

GBPAUD

The pair will continue to go up after it broke out from 50 MA, sending the pair lower towards the nearest resistance line. The extension and uncertainty of the Brexit is putting the future of Australia at dim. Australia recently entered a recession for the first time in 27 years and will face a looming federal election. On the other hand, UK had announced that it will allow the Chinese technology giant Huawei to participate in building the country’s Fifth Generation (5G) telecommunication network and says that the threat from the company is manageable, defying the United States pressure among the Five Eyes Intelligence Alliance. Australia was the only remaining country, aside from the US, that still bans Huawei from it 5G infrastructure. Despite this, however, Huawei Australia sees a bigger profit and revenue growth, while skirting the ban impact. Histogram and EMAs 13 and 21 will continue going up.

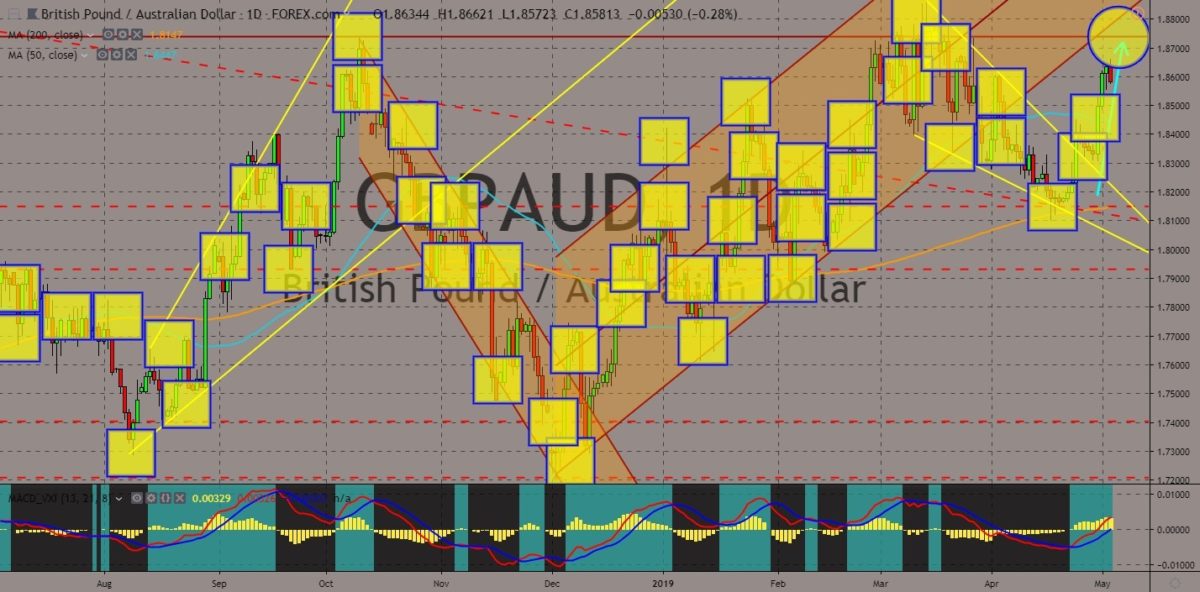

GBPCAD

The pair failed to sustain its rally, sending the pair lower towards the uptrend support line. With the European Union giving a greenlight for Canada to conduct a free trade agreement, the United Kingdom loses its place in Canada. The withdrawal of the UK from the EU had forced their allies to take sides when making a trade agreement. Australia choose UK, while New Zealand have a separate standing trade agreement with the United Kingdom and the European Union. However, the UK and the United States was snubbed at the Franco-Germano led “alliance of multilateralism” with Canada and Japan joined recently. According to new survey, Canadians have more positive opinion of the country’s relationship with the United Kingdom with 86% trust rating compared to Germany with 82%, France with 77%, and 44% for the US. Histogram and EMAs 13 and 21 reverse back in the following days.

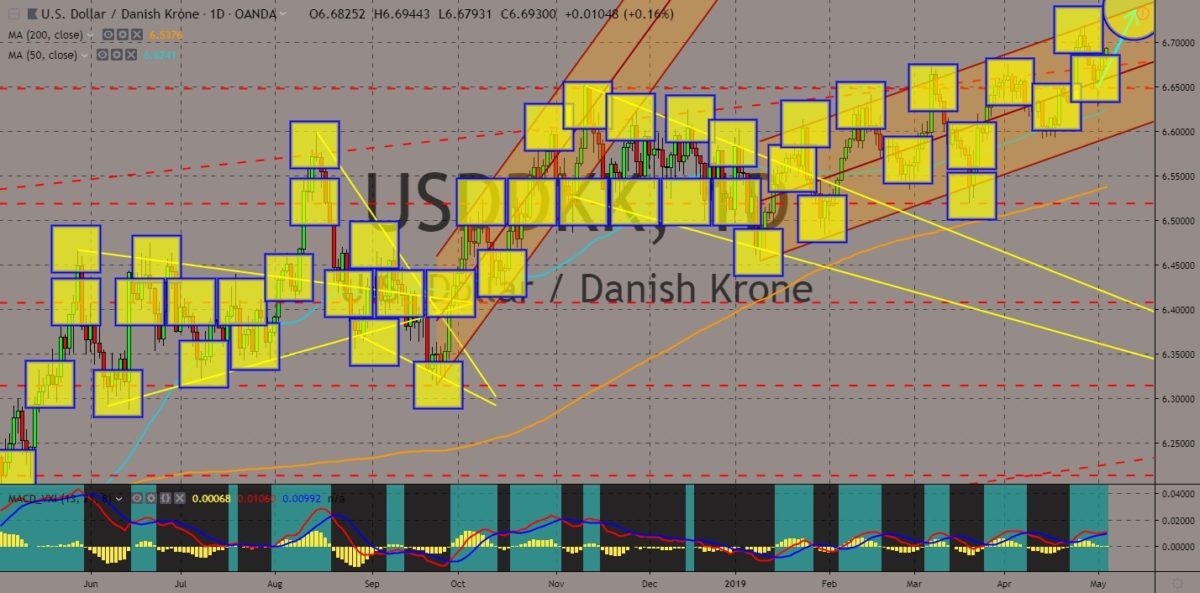

USDDKK

The pair was expected to continue going up in the following days after finding a strong support from the uptrend channel middle support line. The United States was slowly building its influence in Europe with its planned bilateral trade agreement with the United Kingdom and the lobbying of the Eastern and Nationalist bloc, the Visegrad Group. However, the most unexpected ally that the US can have in Europe was Denmark. Denmark has the highest satisfaction of being a member of the European Union among the 28-nation bloc. Aside from this, Denmark was also blocking the installation of Russia’s Nord Stream 2 pipeline on its country, and preferred US’ Exxon Mobil. The United States also support Denmark’s claim in parts of the Arctic region (through Danish Realm of Greenland), which will further increase US’ influence on Denmark’s decision with the future path of the European Union and the Arctic.

COMMENTS