Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDMXN

The pair is struggling on the downward part of the chart. The pair had broken to the most recent support line but managed a slight pullback as the Mexican peso weakened on the ongoing police retaliation. Mexico’s federal police officers are putting up a mutiny over the Mexican government’s decision to make them part of the country’s new National Guard, which is made up of a combined force of the navy, army, and federal police to curb violence and fight organized crime. Earlier this year, the country has faced increased homicide rates to record highs. The plan was proposed by President Andres Manuel Lopez Obrador, and it was only days ago when the plans were put into action. The police officers say that their compensations and benefits will be cut and they could be fired if they refuse to join, on top of the poor conditions on deployments away from home. They also worry about serving under military commanders.

USDNOK

The pair is pursuing an upward trend on the daily chart, with the candlesticks converging on the 200-day moving average line. The pair is now pushing up after falling down to lows in mid-June. The Norwegian krone is seen to be strengthening over the coming year as the rate-setters go for a more hawkish monetary policy than other economies thanks to strong domestic growth. Last month, Norway bucked a dovish trend among central banks. It raised its main interest rate and indicated the possibility of two more hikes in the coming year. In stark contrast to the rest of the world, Norway is enjoying strong growth with inflation near target or even slightly above. For instance, both the European Central Bank and the Federal Reserve have given clues on easing policy as trade wars simmer and uncertainties over Britain’s exit from the European Union weigh down an already weak European outlook.

USDPLN

The pair is inching higher on the chart after slipping to monthly lows in late June. The 50-day moving average on the daily chart appears to be going down, while the 200-day moving average slightly goes up, indicating a possible death cross in the medium term. On the Poland side, the Polish central bank kept its benchmark interest rate unchanged at 1.5%, and this met the expectations of analysts. The central bank ended an easing cycle in March 2015. This month, it also kept its lombard rate at 2.50%, while the deposit rate at 0.50% and the rediscount rate at 1.75% were also unmoved. Meanwhile, central bank governor Adam Glapinski emphasized that there may be no need to move rates until 2022, in spite of the anticipated rise in inflation this year and next. The bank increased its CPI and GDP growth forecasts for 2019 and 2020, with projections supporting the rate path they have been following, according to Glapinski.

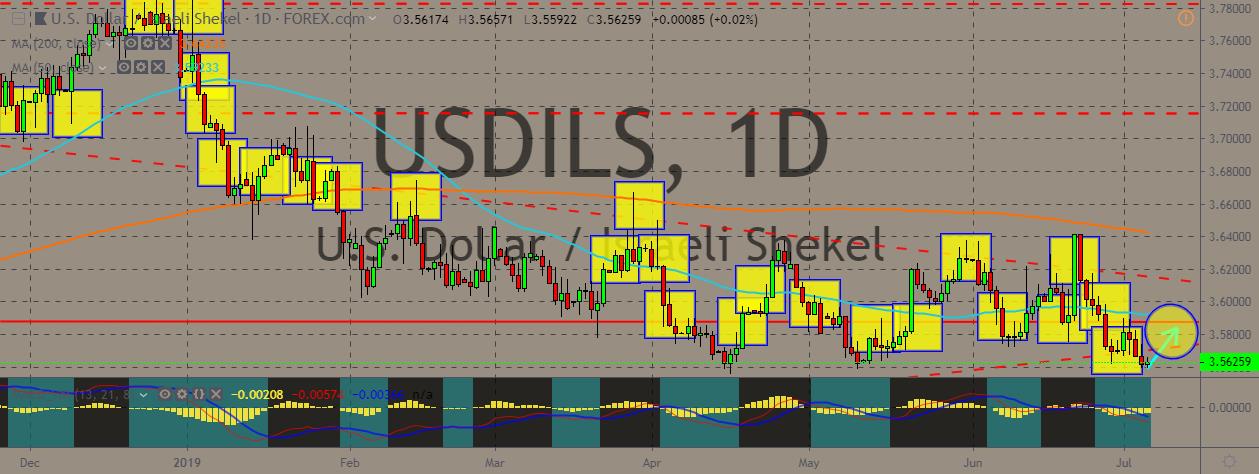

USDILS

The pair is trading on the lower portion of the daily chart, with the dollar appearing to be less strong and the shekel rising. Israel’s central bank is also expected to leave short-term interest rates unchanged for a fifth straight decision next week. It was also seen to scale back expectations of future rate increases because of retriggered global economic weakness. A survey of economists showed that the bank might not be moving the benchmark rate at 0.25%. Last November, the bank made a surprise increase from 0.1%, and then it left the rate unchanged for the next months. During its last meeting on May 20, four out of five monetary policy members voted not to move rates, while the other one voted to a quarter-point increase to 0.5%. The bank of Israel is expected to publish the updated economic estimates on Monday. In April, the bank slashed its 2019 growth forecast to 3.2% from 3.4%. It maintained a 3.5% forecast for 2020.

COMMENTS