Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

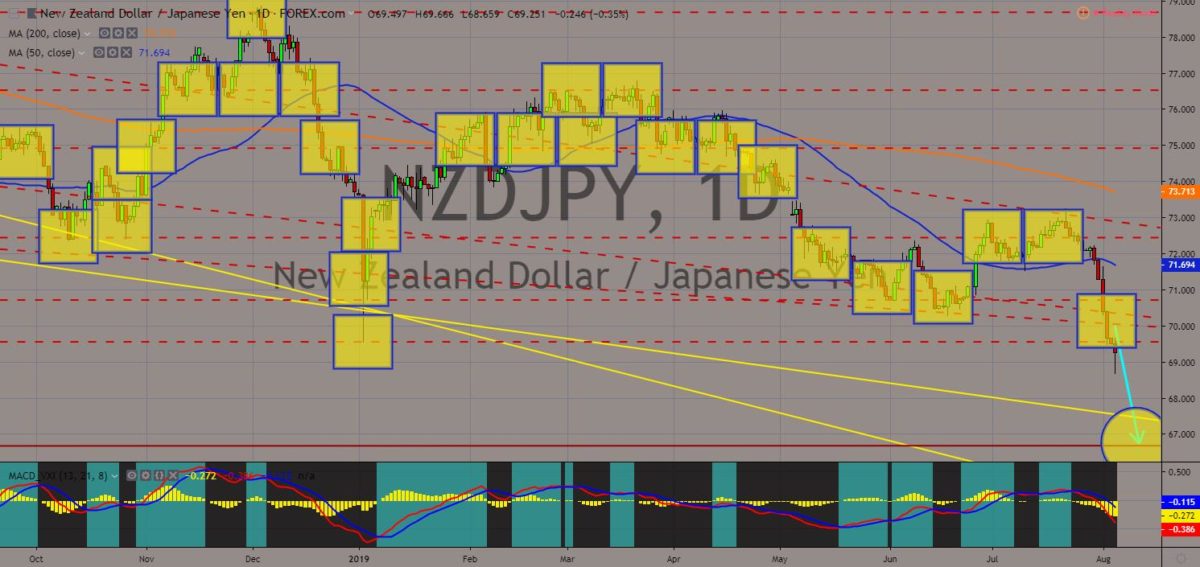

NZDJPY

The pair was seen to continue its steep decline after it broke down from major support lines, sending the pair lower toward its 80-month low. New Zealand Dollar broke down following the decision by the country’s central bank, the Royal Bank of New Zealand (RBNZ) to cut New Zealand’s interest rate. This decision was the result of the escalating trade war between the two (2) largest economies in the world, the United States and China. New Zealand is greatly exposed to the U.S. Dollar, while it treats China as its largest trading partner. Amid this, Japan was increasing its trading partners to escape being too expose to economic powers. Japan has led the ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), after the U.S. left in January 2017. Histogram and EMAs 13 and 21 was expected to continue its downward movement in the following days.

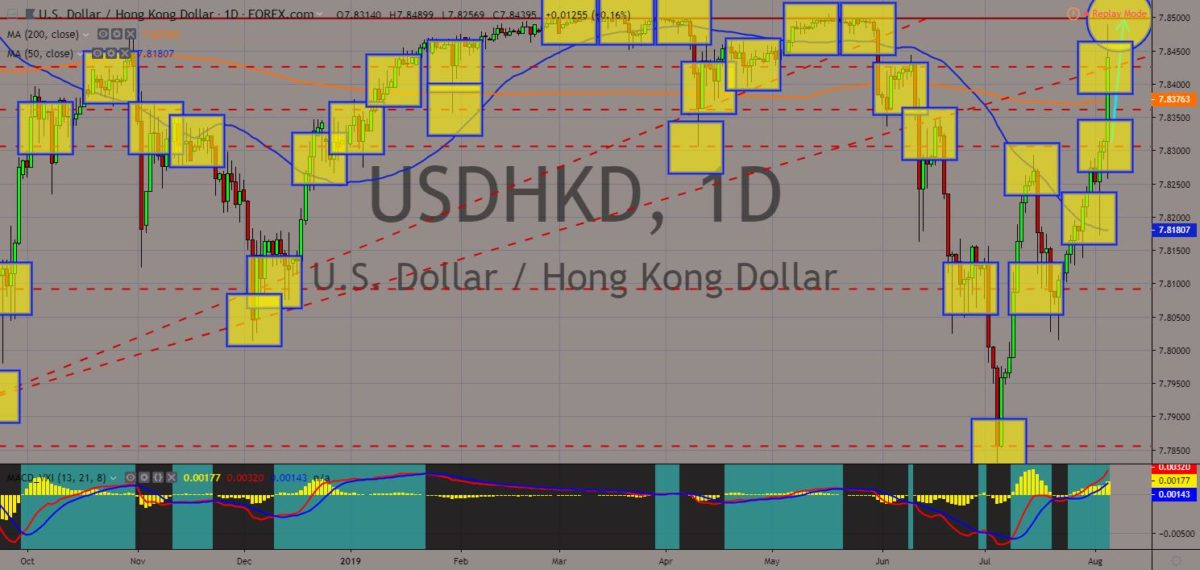

USDHKD

The pair is seen to continue its rally after it broke out from key resistance lines and from 200 MA, which will send the pair higher in the following days. Hong Kong had a history of being a pawn on the politics-turned-economic war between the United States and China. The U.S. accused Hong Kong of being an accessory to defying the U.S. sanctions against North Korea by letting the Chinese Communist Party to create shell companies, which led to the arrest of Chinese telecommunication giant heiress and Global Chief Finance Officer Wang Meng Zhou. Now, China is accusing the U.S. of orchestrating the mass protest in Hong Kong. The mass protest was caused by the Extradition Bill, which will give the Chinese politicians to extradite people who are wanted in China. This was seen by the west as an oppression of Hong Kong’s democracy. Histogram and EMAs 13 and 21 is poised to further go up.

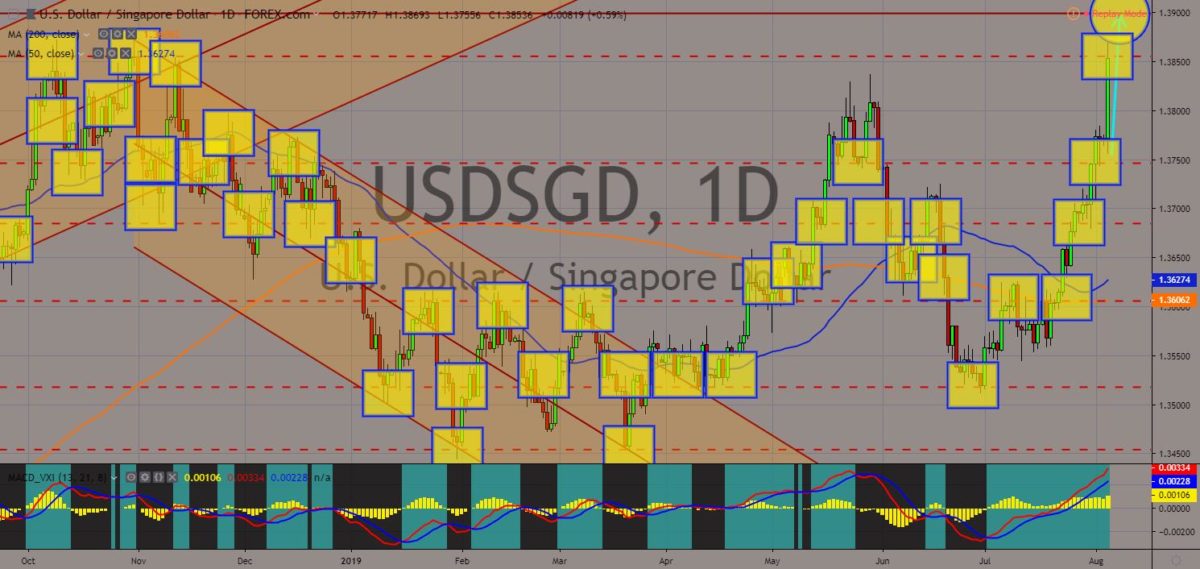

USDSGD

The pair was expected to breakout from a major resistance line, which will send the pair higher toward the pair’s 13-month high. Singapore hosts the United Nations led International Settlement Agreements Resulting from Mediation, which will provide for the enforcement of mediated settlement agreements across countries. Singapore is an important party to treaties being signed between two (2) countries. It is to be noted that the country hosts the first negotiation talks between the United States and North Korea on Pyongyang’s disarmament. This will give Singapore a major influence to orchestrate treaties that can benefit not only the treaty signatories but also the country. Despite this, the United States is still a major driving force in the Asia Pacific, which could benefit the country more than it will benefit Singapore. Histogram and EMAs 13 and 21 will continue to move higher in the following days.

EURDKK

The pair will continue its steep decline after it broke down from MAs 50 and 200, which will send the pair lower towards a major support line. Denmark slipped on the second place to be the most satisfied country among the remaining 27 EU-member states. This was expected to affect Denmark’s influence inside the bloc as the country was seen to replace the United Kingdom on the trilateral power balance together with Germany and France. Aside from this, the election of the new Danish Prime Minister, Mette Frederiksen, had decreased the country’s influence following her meeting with German Chancellor Angela Merkel, one (1) of the de facto leaders of the European Union. Despite this, the United States was still trying to lure EU-member states to increase its influence in the European Union following its narrowing relationship with the Germano-Franco Alliance. Histogram and EMAs 13 and 21 will fall lower

COMMENTS