Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

GBPCHF

The pair has been trading lower in recent weeks, with the British pound losing strength against the safe haven Swiss franc in the past months but now appearing to point upwards after reaching a critical low level. On the UK side, Prime Minister Boris Johnson has told the European Union that the backstop plan for the Irish border must be ditched because he described it as “unviable” and “anti-democratic.” Johnson said that the backstop, which is seen as a tool to avoid a hard border, would probably undermine the Northern Irish peace process. If the backstop plan would be ditched, Johnson believes that a Brexit deal would be passed by the Parliament. On the flipside, the EU has repeatedly insisted that the backstop must remain part of the withdrawal agreement and thus it cannot be changed. The said border remains a hot topic with great political, security, and diplomatic sensitivity.

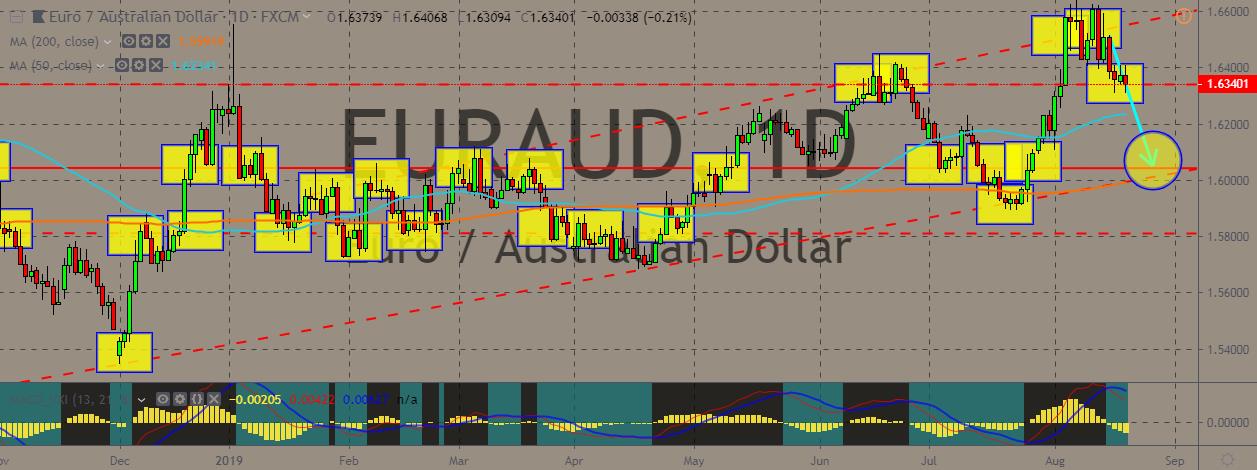

EURAUD

The pair has whipsawed in the previous week, unable to break higher than the multi-month highs it recorded recently. It ultimately headed downward and currently rests at a support level nearl the 1.6400 handle. The 50-day moving average is still trading above the 200-day counterpart, indicating a bullish trend for at least the short-term, although the value of the pair could be dragged down by a plethora of factors. On the Eurozone area, the weaker-than-expected Eurozone inflation for July fueled pressure on the European Central Bank policymakers to consider more stimulus in September. Eurostat has revised its July estimate for consumer price growth to 1%. Meanwhile, the Reserve Bank of Australia board has discussed methods of pumping more money into the economy amid mounting concerns over trade tensions between China and US as well as fears of a local economic turmoil.

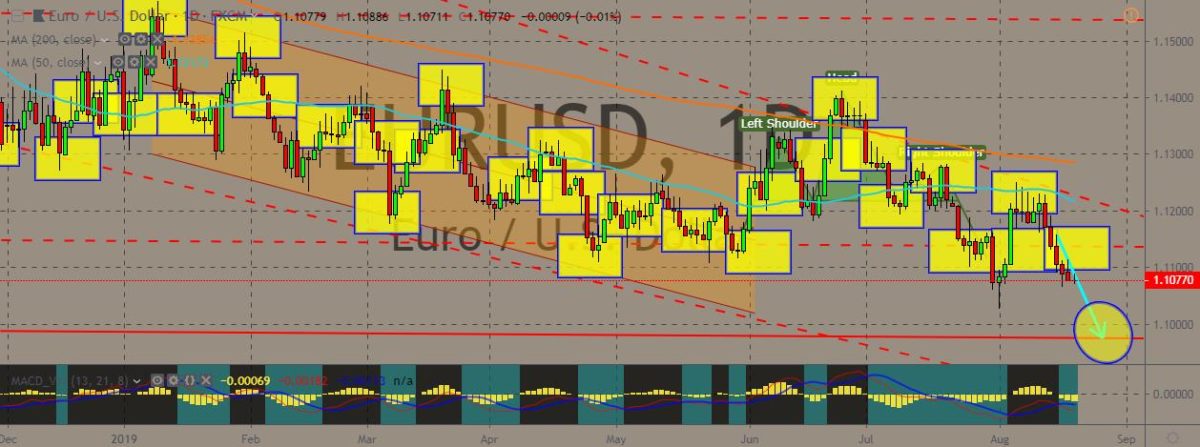

EURUSD

The pair is trading steadily downwards during the past few trading sessions, with the US dollar gearing up against the common currency. The euro is trading near last week’s lows as the markets await big news from the Italian parliament. Prime Minister Giuseppe Conte is scheduled to speak later in the afternoon and most are expecting him to resign ahead of a no-confidence vote that has been called upon by the right-wing Lega party. On the economic front, the euro is also being at a disadvantage as the Deutsche Bundesbank warned in its monthly report that it expects second consecutive quarter of contraction in the summer. That means that the Eurozone’s traditional powerhouse would experience a recession for the first time in a decade. The dollar is benefitting from this. The buck is currently building momentum as the politics-filled trading day continues to drag on.

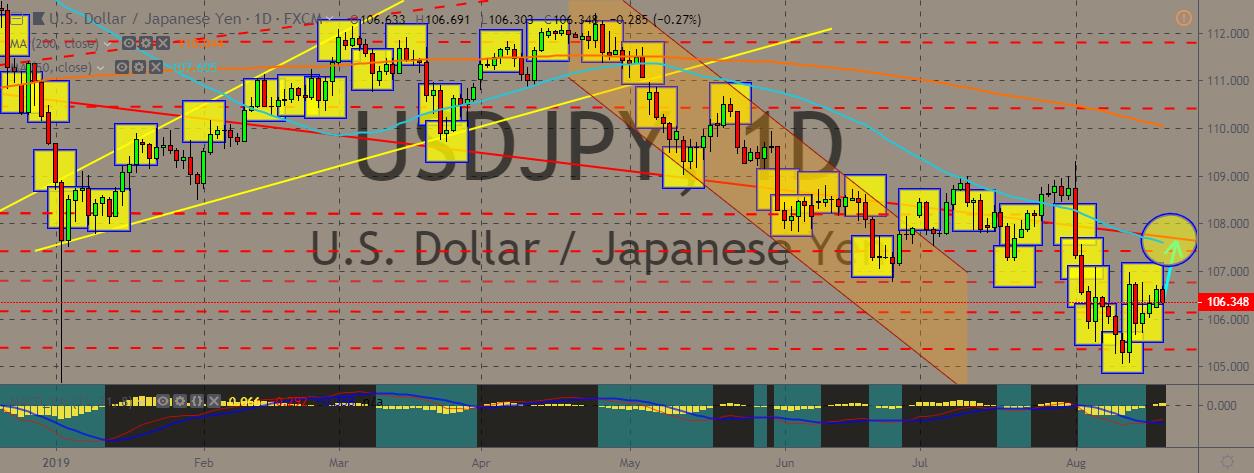

USDJPY

The pair is spending its time on the lower parts of the charts, with the weakness in US dollar since the US-China trade war escalated persisting. However, the greenback appears to be recouping some of its strength in the recent weeks, although the Japanese yen’s appeal is still undeniable, particularly on the current economic and political climate around the world. Investors are suddenly shifting to riskier assets and away from safe haven. There has been an apparent development in the US trade negotiations, which helped buoy sentiment in the market. Along with the strength of the dollar, Asian stocks also probably helped further boost sentiment. Federal Reserve Bank of Boston President Eric Rosengren took the spot light and pushed back against further rate cuts, saying that he wasn’t convinced that slowing trade and global growth will significantly damage the economy.

COMMENTS