Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

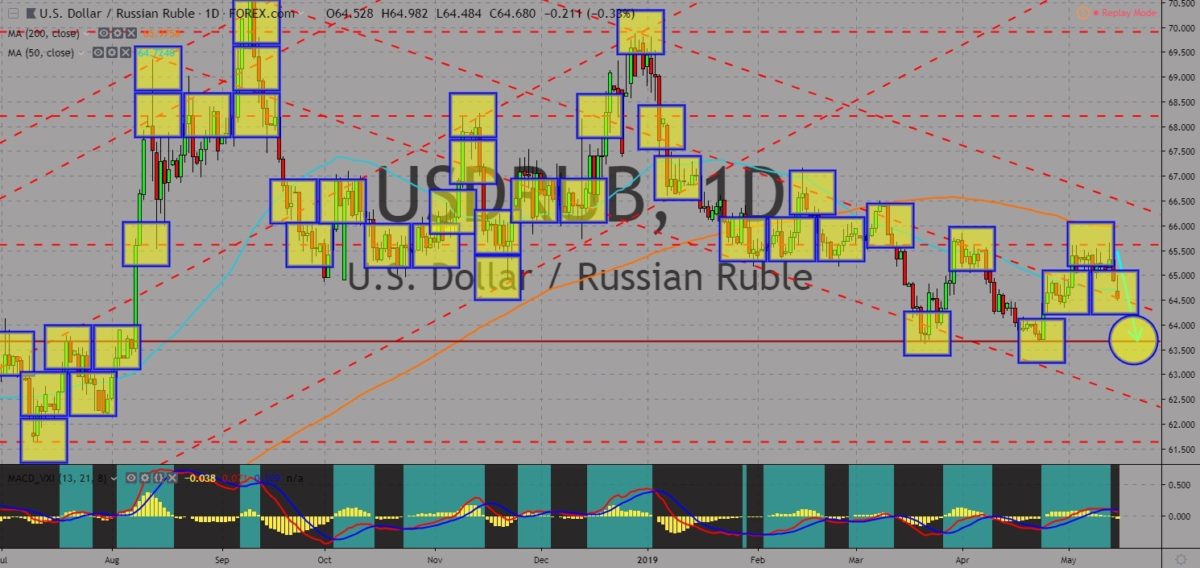

USDRUB

The pair was expected to move lower in the following days following the gap down and after the pair broke down from 50 MA. Following the withdrawal of the United States and Russia from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces), the two (2) countries had been increasing their military presence as they prepare for a possibility of a new era of Cold War. Russia was seen building up its military bases near the arctic ocean as the region’s ice melt at a fast pace, paving way for a new territory to be disputed by countries surrounding it, which includes the United States, Russia, Canada, Denmark, and Norway. Aside from that, Russia had been aggressive in the Black Sea with its annexation of Crimea, a Ukraine territory. Russia was also lobbying Turkey to purchase the country’s S-400 anti-aircraft defense system. Histogram and EMAs 13 and 21 will continue its downward movement.

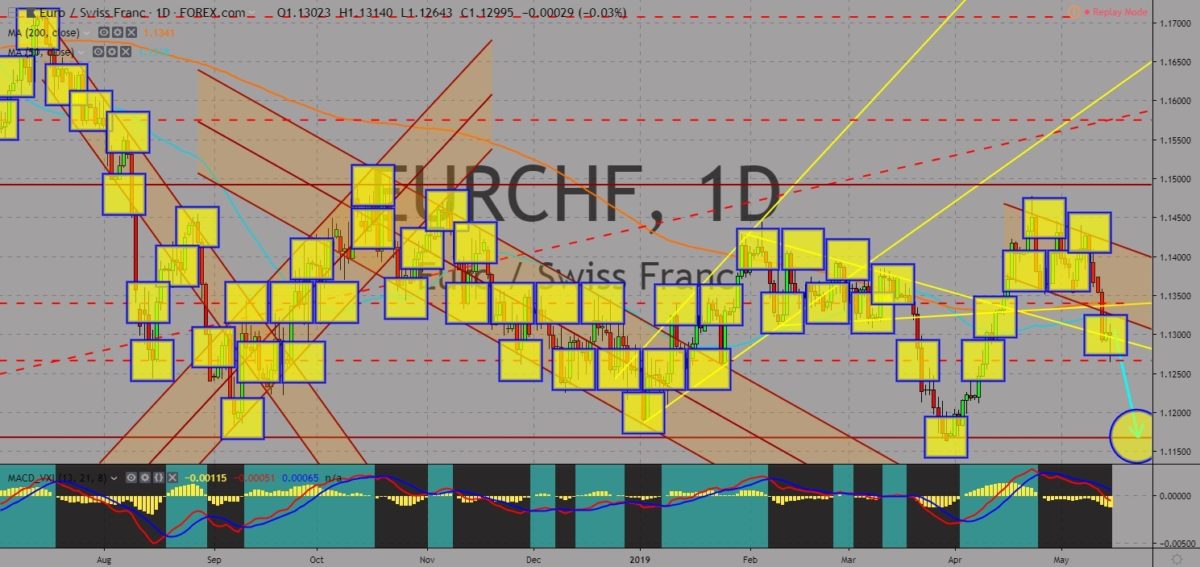

EURCHF

The pair was seen to continue its steep decline and to break lower from its current support line, sending the pair lower towards a major support line. Only eight (8) days remaining before the European Union will cast its vote during the European Parliamentary Election to elect the new Members of the Parliament. The election will also clear the question regarding the future relationship between the European Union and Switzerland after the later signed a post-Brexit trade agreement with the United Kingdom, while declaring the “Framework Deal” by the European Union, which incorporates all the existing bilateral trade agreement between the two (2) economies, as dead. With the scenario of the Germano-Franco alliance losing during the election, the European Union’s influence in Europe might weaken, making room for non-EU countries to dominate the region. Histogram and EMAs 13 and 21 will continue to move lower.

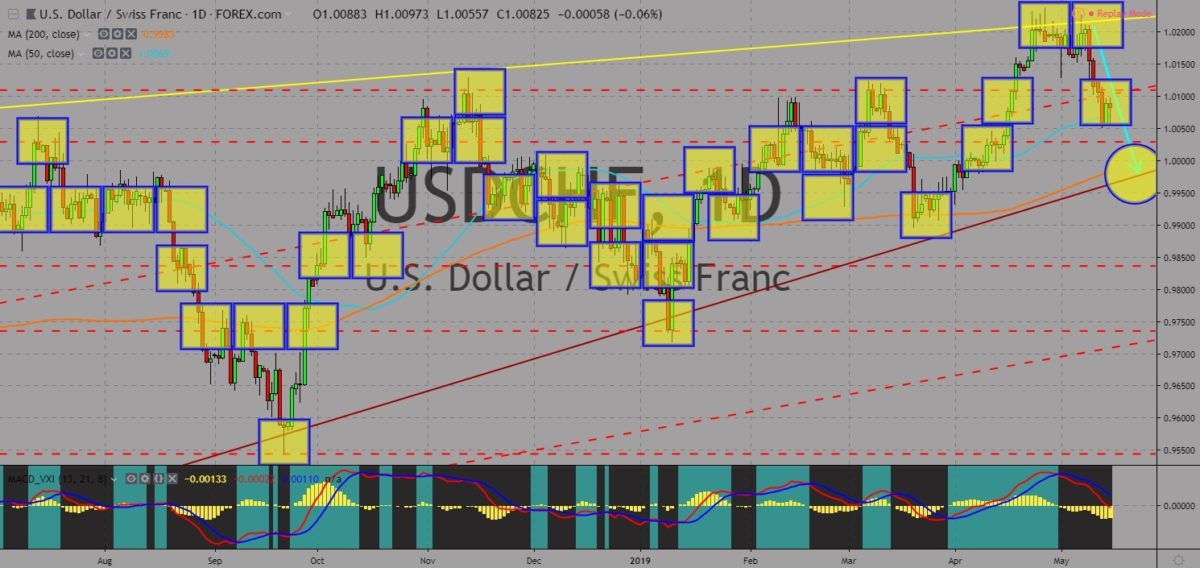

USDCHF

The pair broke down from an uptrend support line and was expected to continue its downward movement. Following the declaration of Swiss President Ueli Maurer that the proposed “Framework Deal” by the European Union to Switzerland was dead, the United States was seen lobbying Switzerland to further increase its influence in Europe following the fallout of its relationship to the Germano-Franco led European Union. Aside from Switzerland, the U.S. was looking to sign a bilateral trade agreement with the United Kingdom once it officially leave the bloc. The U.S. was also lobbying the Eastern and Nationalist bloc, the Visegrad group, to make it as a buffer to Russia’s aggression on its border with European countries. U.S. Secretary of State Mike Pompeo was expected to visit Switzerland by May 30 to June 05 this year. Histogram and EMAs 13 and 21 was expected to continue to move lower in the following days.

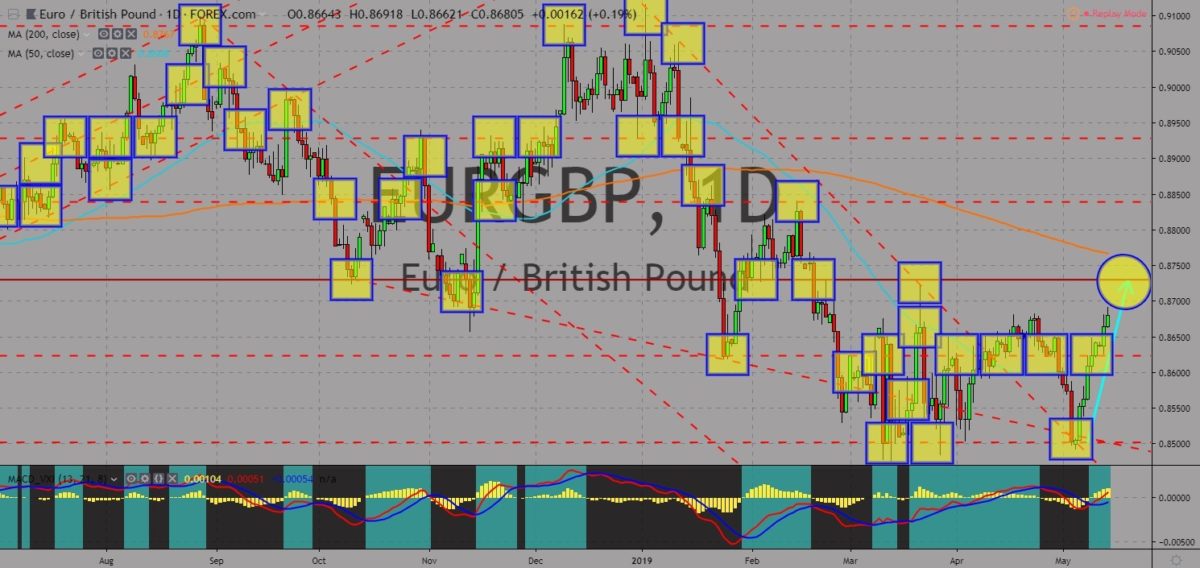

EURGBP

The pair will continue its rally after it bounced back from its previous low, sending the pair higher towards its previous high. The United Kingdom will participate in the upcoming European Parliamentary Election on May 23-26 as UK Prime Minister Theresa May failed to prevent its participation due to the Brexit extension until October 31. However, this participation gave hope for parties who wish for UK’s cancellation of the Article 50 or Brexit as previously stated by the European Parliament. Poland’s Minister of Foreign Affairs Jacek Czaputowicz and Norway’s Minister of Foreign Affairs Ine Eriksen Soereide had both told the EU Parliament for the European Union to allow the United Kingdom to have more time to reconsider the Brexit. The United Kingdom was the second largest economy in the European Union after Germany. Histogram and EMAs 13 and 21 will continue its upward movement.

COMMENTS