Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

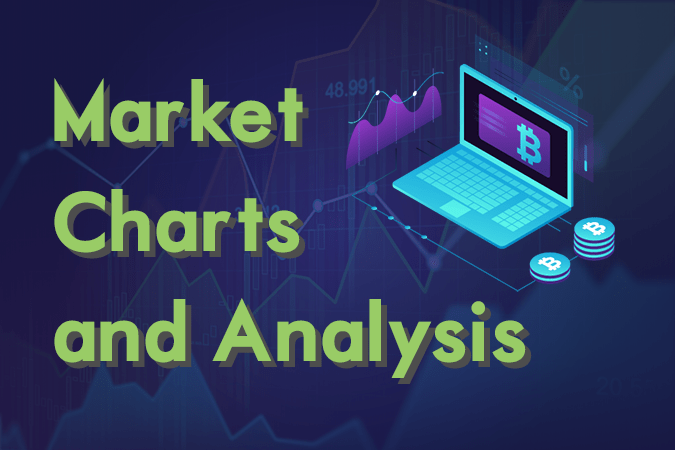

AUDUSD

The pair was seen to further go lower in the following days after it broke down from a major support line. Australia had been an old ally of the United States and had been a key player for U.S. influence in the Asia Pacific. However, with the changing dynamics of geopolitics, Australia’s reliance on the United States had been damaging the country. This was following the trade war between the U.S. and China wherein the later was Australia’s largest trading partner. In March 2019, Australia entered its first recession in 27 years following the slowdown of trade partnership between the country and China amid the ongoing trade war between the two (2) largest economies in the world. Aside from China and the United States, Australia was also divided between the European Union, and its former colonial master, the United Kingdom. Histogram and EMAs 13 and 21 will continue its downward movement.

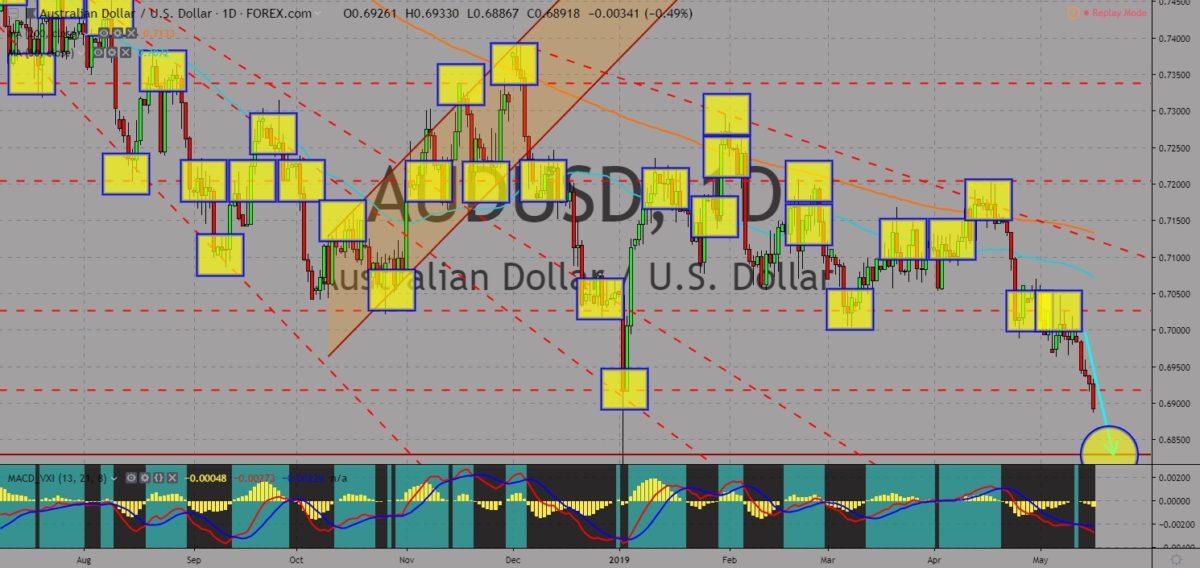

AUDCAD

The pair will continue its steep decline following the looming crossover between MAs 50 and 200, which will result to a “Death Cross”. Australia and Canada were caught between the trade war of the largest economies in the world, the United States and China. Canada was the only country among the Five Eyes Intelligence Alliance that didn’t ban the Chinese telecommunication giant Huawei amid concerns from the U.S. of the company’s cyber espionage. New Zealand and the United Kingdom took back their words and announced that their governments are willing to work with Huawei, which leaves Australia and the United States among the Five Eyes to still at ban with Huawei. The move by Australia cost its economy to enter a recession for the first time in almost a decade, while Canada had shifted its focus from China to its economy. Histogram and EMAs 13 and 21 will go lower in the following days.

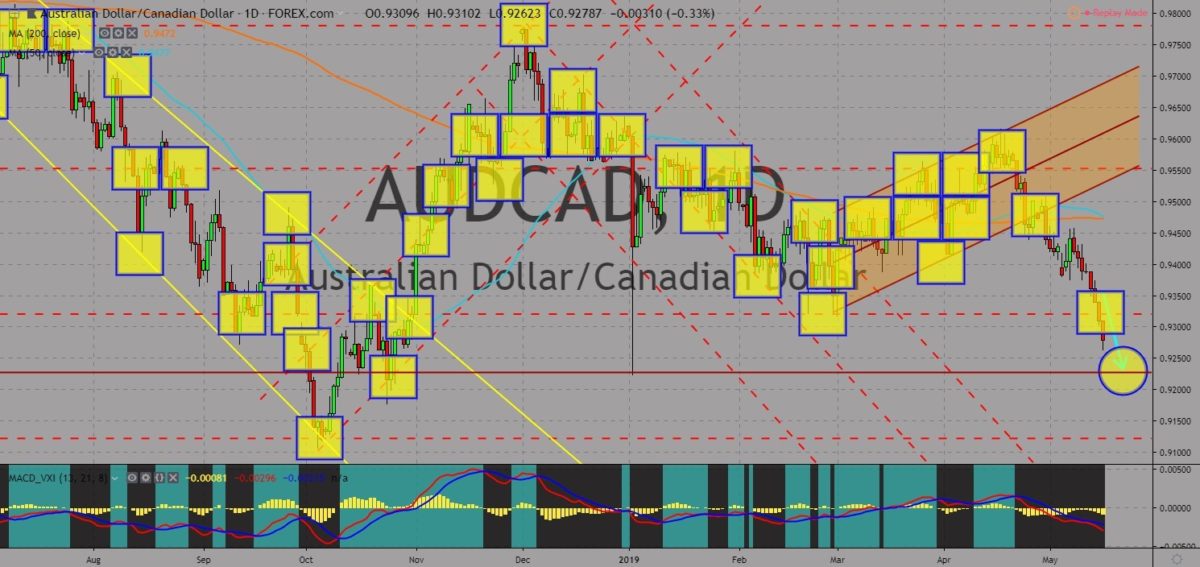

AUDCHF

The pair was seen to break down from a major support line, sending the pair lower towards the downtrend support line. Following the impending European Parliamentary Election on May 23-26, with the United Kingdom participating on the said election amid the Brexit extension, countries, including Australia and Switzerland, who signed a post-Brexit trade agreement with the UK suffers the consequence of the extended Brexit. The agreement will only take effect once the United Kingdom officially leaves the European Union and countries who signed the agreement risks of ruining its relationship with the EU. However, between Australia and Switzerland, the former was the most affected after the trade war between the United States and China had risked Australia’s chance of striking a bilateral trade agreement with the country. Histogram and EMAs 13 and 21 will continue its downward movement.

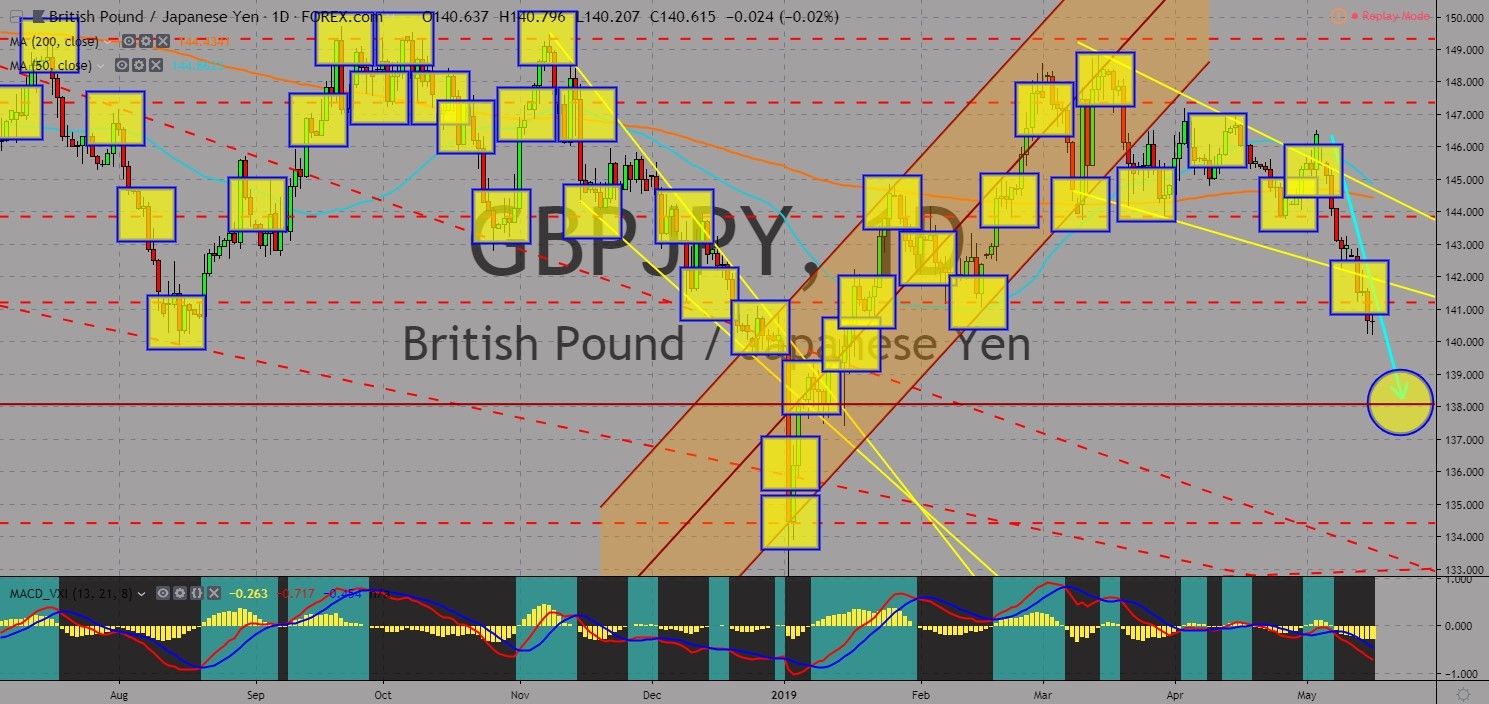

GBPJPY

The pair was expected to continue its steep decline after it broke down from a major support line and from the “Falling Wedge” pattern support line. Japan was seen rising from ashes after the country was hit by the trade war between the United States and China. Japan had recently ratified the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), and the EU-Japan Free Trade Deal, which became the largest trading zone in the world. U.S. President Donald Trump was also set to visit Japan at the end of the month as the first foreign leader to visit the new Japanese Emperor Nahurito. President Trump and Japanese Prime Minister Shinzo Abe was also set to discuss creating a bilateral trade agreement. The United Kingdom on the other hand, was on an uncertain path following the Brexit extension. Histogram and EMAs 13 and 21 will go lower in the following days.

COMMENTS