Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

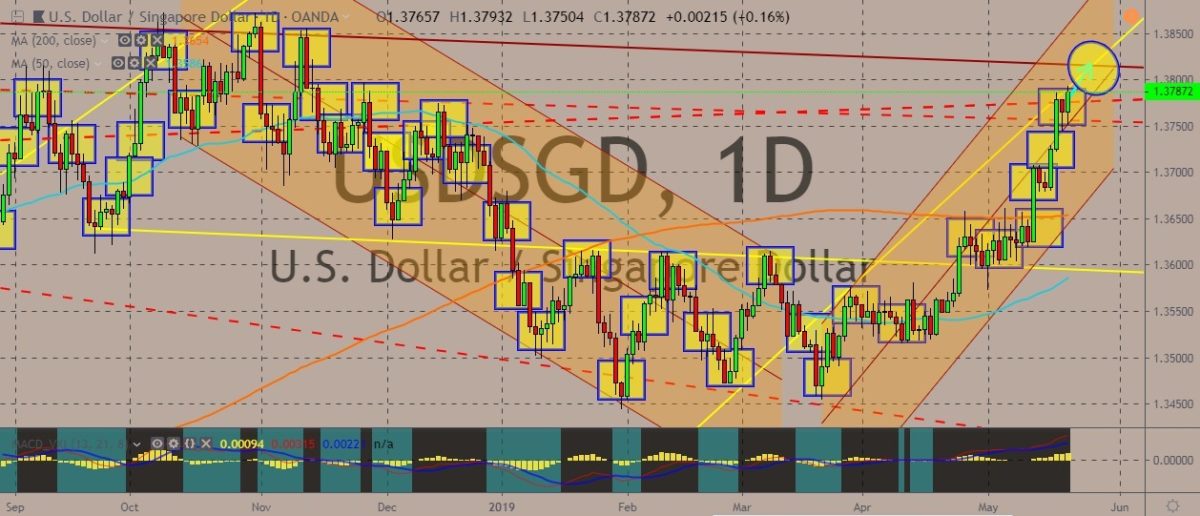

USDSGD

The USDSGD pair is seen nearing a key parallel channel, with the overall direction still upwards. The 50- and 200-day MAs appear to be supporting the trend as the price movement just broke into two consecutive resistance levels, poised to move towards another resistance level. The Singapore dollar is expected to weaken further against the greenback as the Singaporean economy continues to slow down. The Ministry of Trade and Industry lowered the 2019 growth to a range between 1.5% and 2.5% from the previous 1.5% and 3.5% levels. The Singaporean economy grew 1.2% in the first quarter of this year—this was its slowest growth rate in more than 10 years. The US dollar, even though pressured by the intensifying trade spat with China, still retains much of its strength against the Singapore dollar. Just today, the US government lifted the restrictions it slapped over Huawei, boosting equities. Overall, the pair is expected to stay within the channel, upwards a key resistance level.

EURDKK

The pair is seen reaching a resistance level, diminishing the pair’s upward momentum. The euro is expected to further slide down as the European elections loom large in the financial markets. The European Parliament elections are scheduled this week, starting on Thursday and expected to end on Sunday. Most analysts are expecting the election results to confirm the rise of populism in the region as well as Euro-skepticism. This, along with other factors, could mean a further weakening for the common currency. Meanwhile, Denmark will reportedly deploy fighter aircraft on its Greenland bases, the world’s biggest island, if Russia violates the Greenlandic airspace. According to the Danish military, Russia is within reach of Greenlandic airspace without hindrance. Denmark’s defense minister said that the country is currently unable to stop this, thought they “cannot tolerate violations of the Danish airspace. Overall, the pair is expected to edge toward the negative as tensions in Europe continue to pile up.

EURTRY

The EURTRY pair is seeing mixed signals from bulls and bears as the two currencies struggle with geopolitics and shortly after the 50- and 200-day MAs built the death cross. The Turkish lira is seeing cautious movements as Turkish authorities commanded the banks today to postpone or delay some purchases of foreign exchange, conjuring some concerns about possible capital controls. The financial industry watchdog said that banks needed to cancel retail foreign currency purchases amounting to $100,000 by one day. Istanbul has taken nearly 13% losses so far this year. The postponement was among the most recent unorthodox steps that Turkey has taken to stem losses in its currency. Last year, the Turkish lira lost nearly 30% of its value against the dollar because of an overheating economy as well as a political dispute with the United States. Overall, the pair is expected to rise in the short-term but not farther away from the most current resistance level.

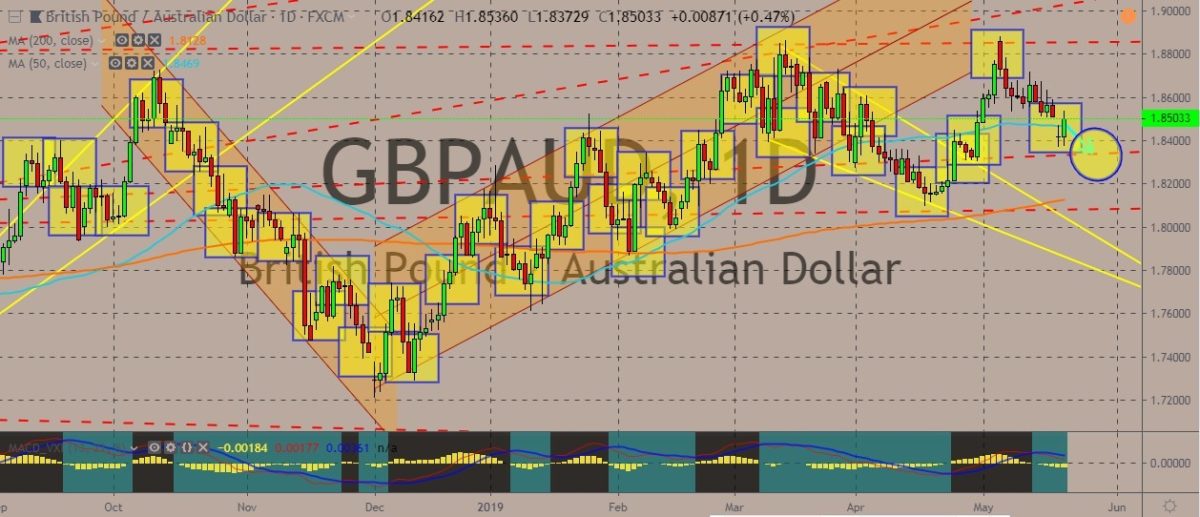

GBPAUD

With the Australian elections just starting to wrap up, the GBPAUD pair is getting some downward momentum. The pound has given up some ground for the Aussie after the Australian general election finished and saw Scot Morrison’s center-right government bagged the victory, even after lagging behind rivals in most surveys. It didn’t help that political frictions and tension in Britain still remain as the Brexit discussion appears to be persisting even after months of negotiations. Previously, the Aussie lost some of its strength because of the US’ trade war against China, which is Australia’s biggest trading partner. The Reserve Bank of Australia is widely considered to be edging closer to their first change in interest rates since 2016. On the sterling side, the fourth crucial vote of Theresa May’s proposed exit strategy from the EU will be held on June 3. Such event is expected to cause major volatility for the pair. Overall, the pair is seen to fall in the short-term towards the nearest support level.

COMMENTS