Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

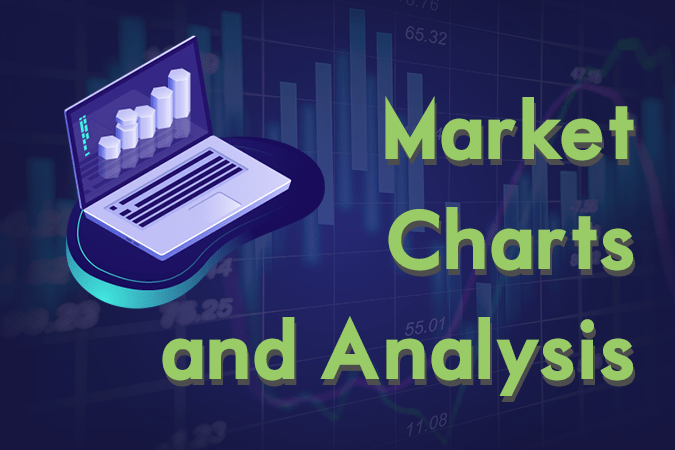

USDCZK

The pair was expected to fail to break out from a major resistance line, sending the pair lower towards the uptrend channel support line. Following the win of Germany’s European People’s Party (EPP), the Germano-Franco Alliance was still seen to dominate the European Union. This will further push the Visegrad Group comprising of Hungary, Poland, Czech Republic, and the Slovak Republic, to the United States. However, it was not only the U.S. that was seen increasing its influence in the European Union, but also China, who recently meet with the two (2) de facto leaders of the EU, German Chancellor Angela Merkel and French President Emmanuel Macron. The meeting focuses on the Chinese Belt and Road Initiative. Czech Republic, who was a major consumer of Chinese telecommunication Huawei was also planning to be part of the BRI. Histogram and EMAs 13 and 21 will reverse in the following days.

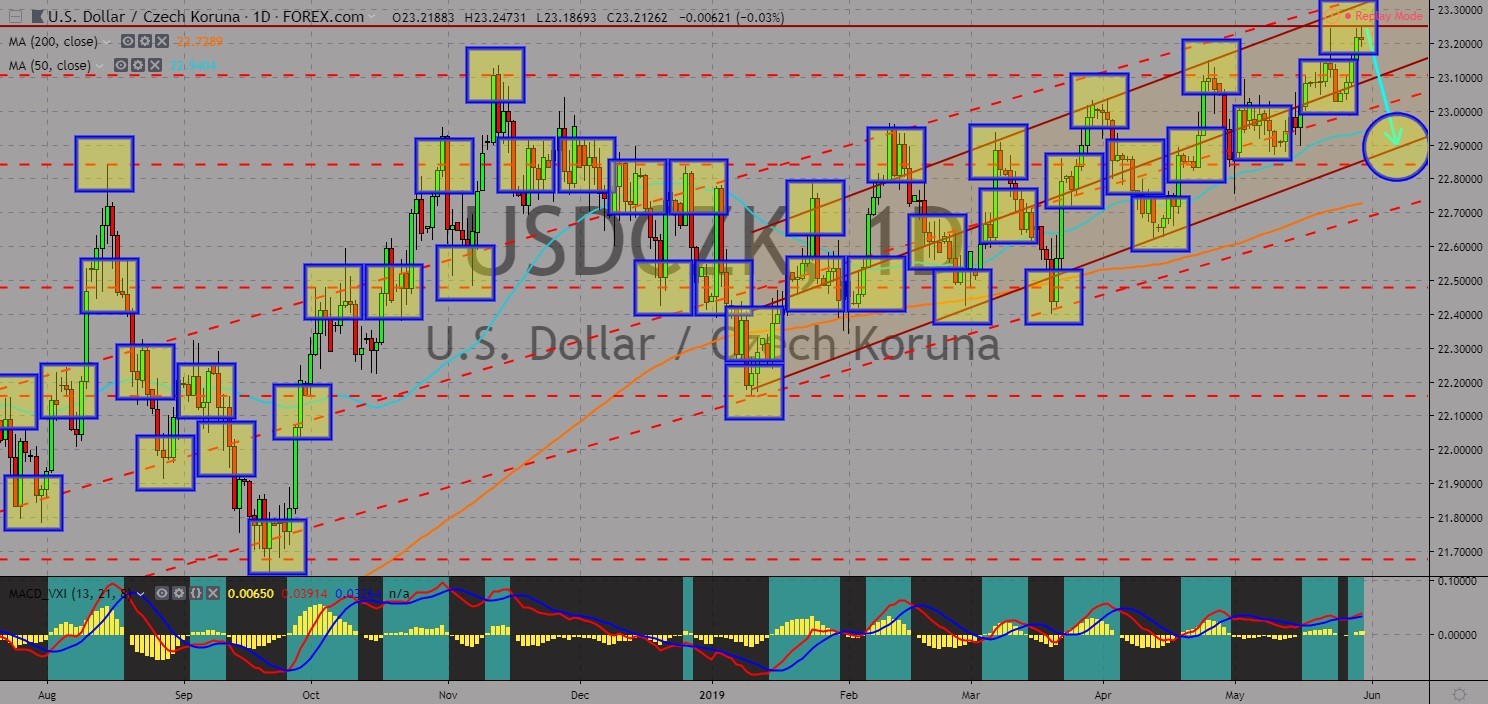

USDHUF

The pair was seen to move lower in the following days after it failed to breakout from a major resistance line. Following the fallout of the relationship between the United States and Turkey, the U.S. halted its selling of F-35 fighter jets to Turkey. The cancellation of F-35 was seen by the United States to strengthen its allies guarding the Baltic Sea and the Baltic Sea. The U.S. will sell F-35 to Poland and Romania. Aside from these countries, the populist government of Hungarian Prime Minister Viktor Orban was also planning to buy the F-35s. However, the relationship between the United States and Hungary might fall down with the issue regarding George Soros, a Hungarian-American investor, most commonly known as the man who broke the Bank of England, following tirades from PM Orban on the Soros owned Central European University. Histogram and EMAs 13 and 21 was poised to continue its decline.

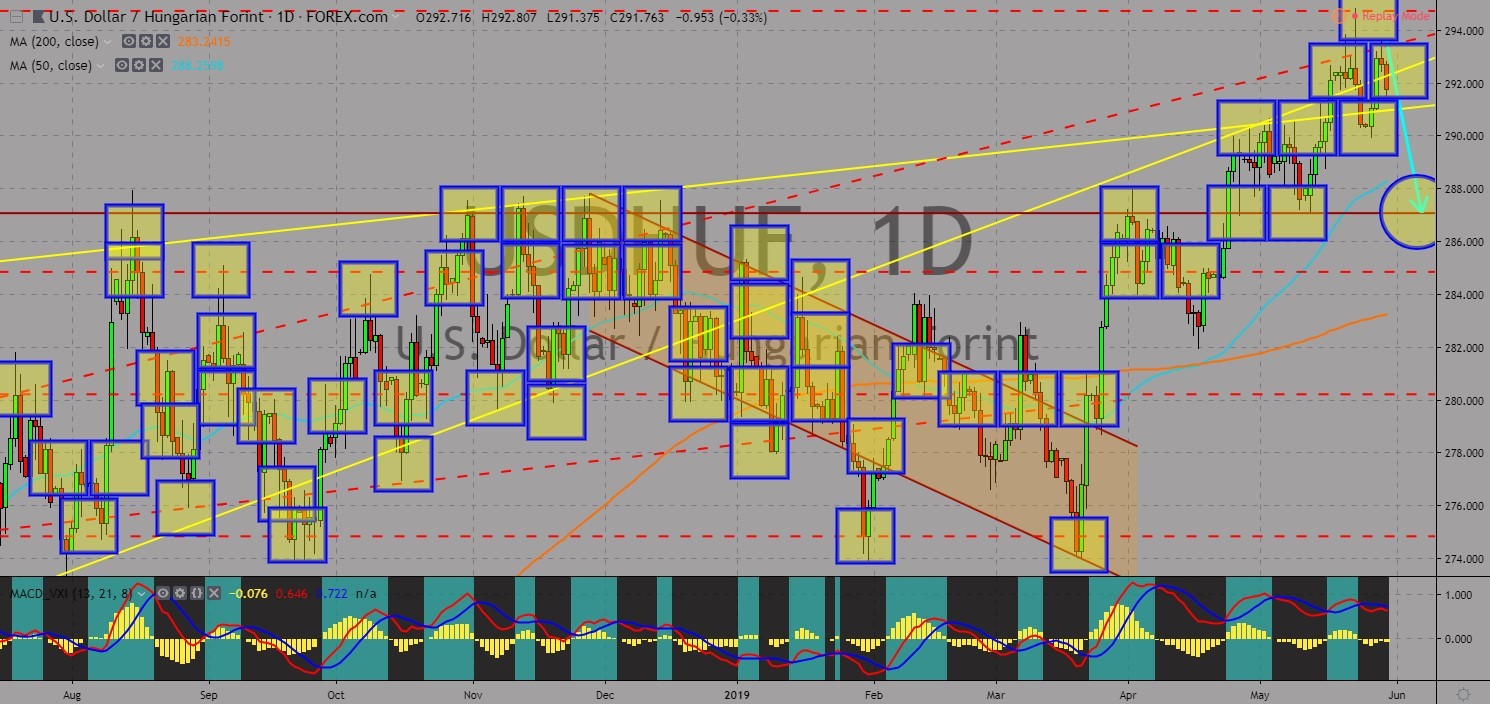

USDMXN

The pair was expected to continue to go up after a long move yesterday, May 30, had caused the pair to breakout from 200 MA and other major resistance lines. With the escalation of trade war, which started between the United States and China, the U.S. had now imposed 5% tariffs on all Mexican goods, which further strained U.S.’ relationship with its neighbors. The move by U.S. President Donald Trump was seen as a warning and pressure to the U.S. Congress to pass the ratified NAFTA (North American Free Trade Agreement) and to fund the border wall that President Trump had promised during his election in 2016 to curb migration from Central America. Earlier, the United States had lift tariffs to Mexico and Canada, which was seen to restart President Trump’s plan to put pressure on the U.S. Congress through putting tariffs on all Mexican goods. Histogram and EMAs 13 and 21 successfully crossed over.

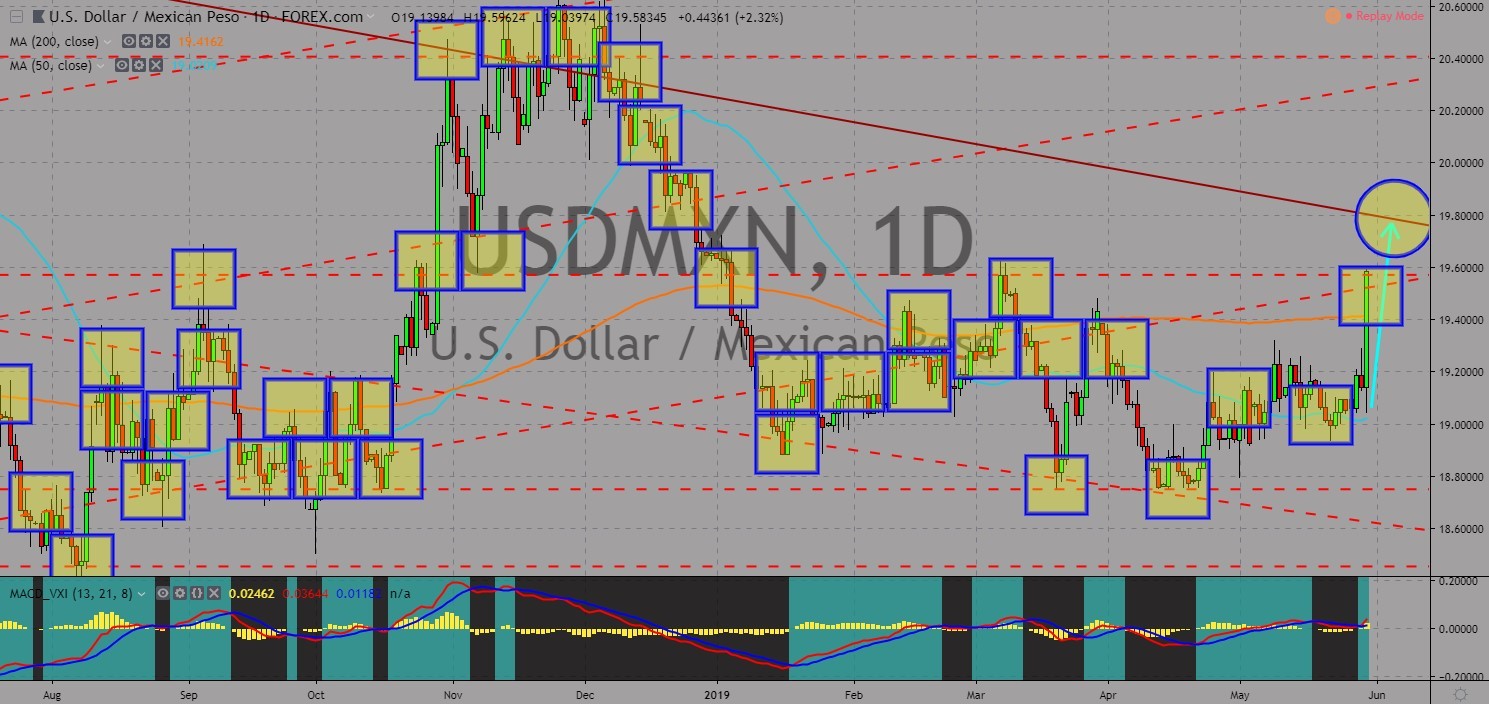

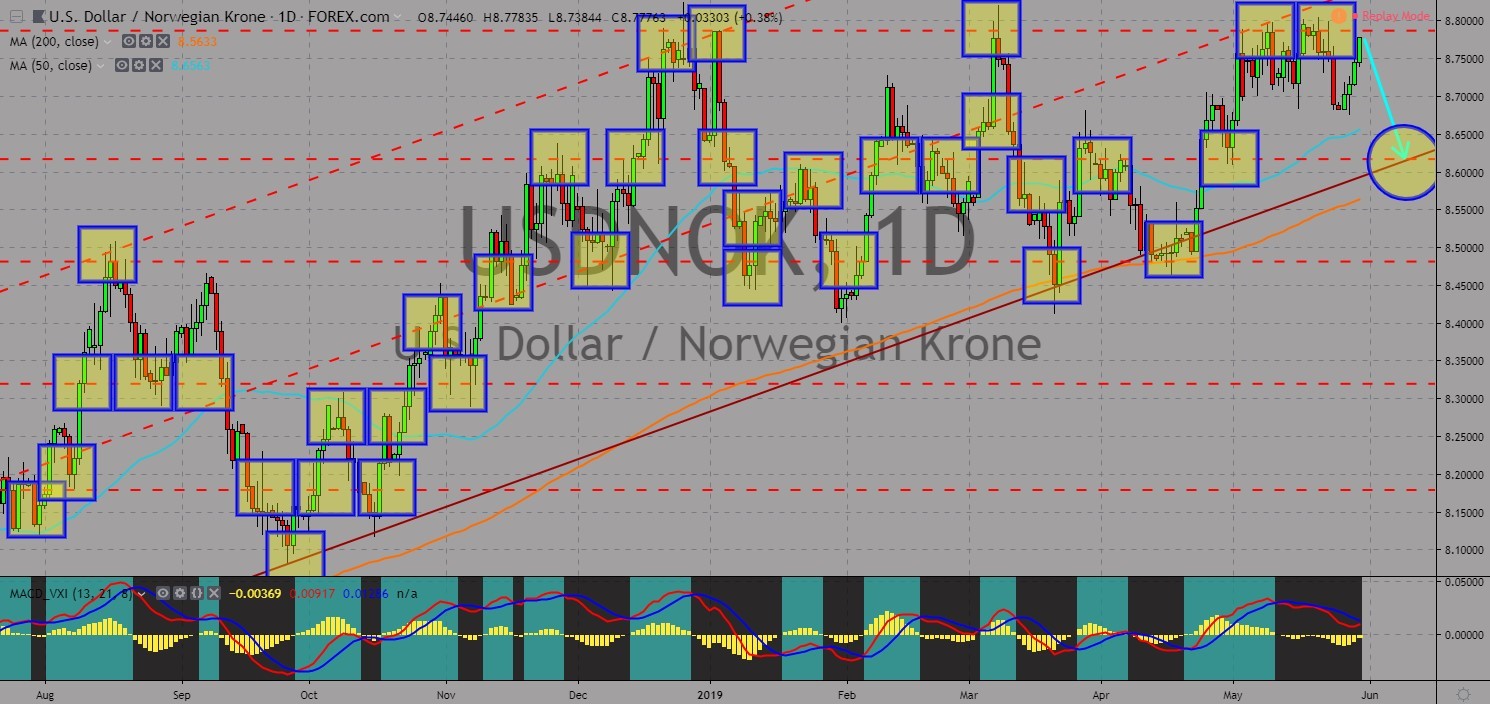

USDNOK

The pair was seen to fail on its 7th attempt to break out from a major resistance line, which will send the pair lower towards the uptrend channel support line. Following the withdrawal of the United States and Russian from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces), the possibility of a new era of Cold War was revived. The backing of the U.S. to the Syrian opposition and Venezuelan opposition and Russia’s backing of the Assad government in Syria and the Maduro government in Venezuela was seen as a result of the withdrawal of the two (2) nuclear-armed countries. The U.S. and Russia’s military conflict now moves to the arctic ocean as the region’s ice quickly melts, paving way for a new territorial dispute between the United States, Russia, Canada, Denmark, and Norway, with the later needing the backing of the U.S. Histogram and EMAs 13 and 21 will fail to crossover.

COMMENTS