USDPLN

The pair was expected to move higher in the following days after it found a strong support line. Poland was sliding back from the European Union despite the efforts by the new European Commission President, Ursula von der Leyen, to unite the EU-member states. Poland supports the proposal by the Ukrainian President Volodymyr Zelensky to expand the Normandy format on setting conflicts and to invite the United States and the United Kingdom to these negotiations. The Normandy was composed of Ukraine, Germany, France, and Russia. The group was formed particularly for resolving the war in Eastern Ukraine, which Russia was supporting. Th group was formed in 2014 during Russia’s annexation of Crimea. Aside from this, U.S. President Donald Trump is set to visit Poland from August 31 to September 03. Histogram and EMAs 13 and 21 was expected to crossover in the following days.

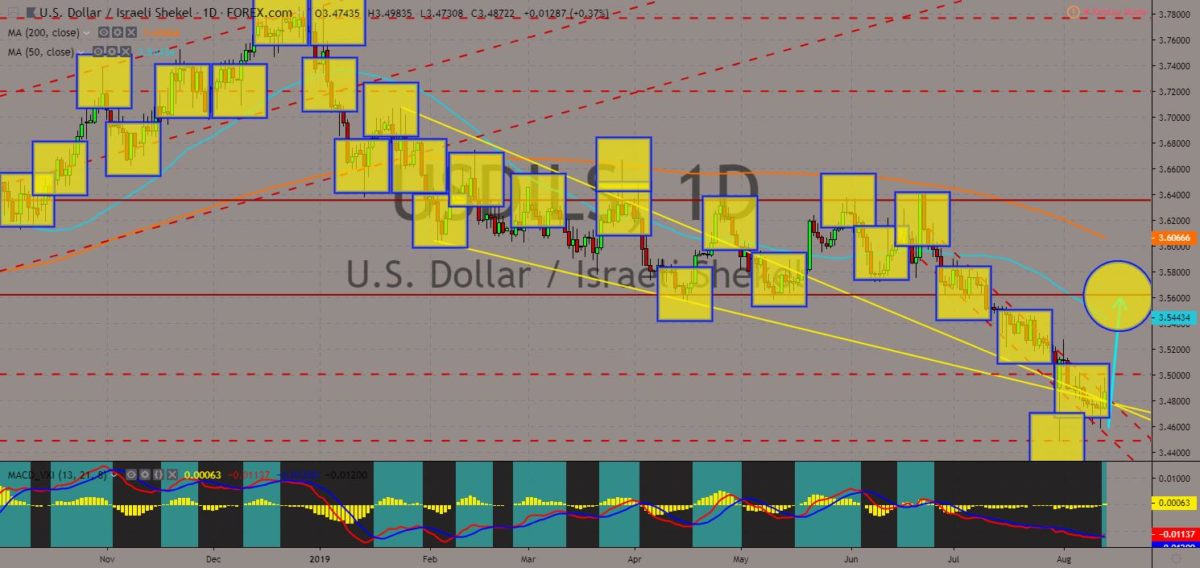

USDILS

The pair will continue to go up after it broke out from a steep downtrend channel. Israel bars the entry of two (2) U.S. lawmakers, setting off a new round of controversy in the debate over U.S. support for its ally in the Middle East. It can also be remembered that U.S. President Donald Trump made an unprecedented move for Israel after he acknowledge Gaza Strip, Golan Heights, and West Bank as Israeli territories during the time where Israeli Prime Minister Benjamin Netanyahu was seeking bid for reelection. A century ago, these territories were held by Palestine, a Muslim-majority country. The lawmakers trying to enter Israel were Muslims, making it harder for President Trump to continue its support for Israel. Despite this, however, the purchase of U.S. of Israeli-made Iron Dome was already completed, suggesting a closer cooperation between the two (2) countries. Histogram and EMAs 13 and 21 recently crossed over.

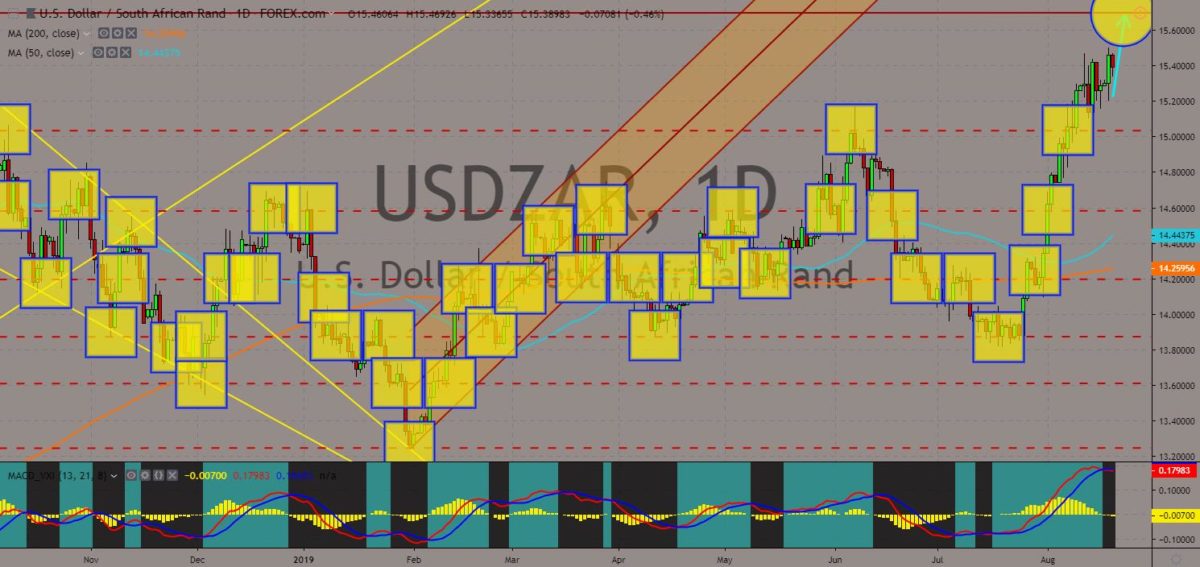

USDZAR

The pair is expected to revisit its September 2018 high after it broke out from major resistance line. South Africa’s economy is in a perilous state and is running out of time to get fixed. This was even after China’s soft loans and grants, which had caused its relationship with the United States to fail. There are four (4) main reasons for this. First, economic growth is low or non-existent. Second, tax revenue collection is reportedly below forecast. Third, debt levels have risen rapidly and are now at their highest levels in the post-apartheid era. Fourth, the poor performance of state-owned enterprises in necessitating large-scale government support. Also, a downgrade of government debt to “junk” by a third rating agency will lead to an outflow of investment and exacerbate matters further, which might in turn lead into a recession. Histogram and EMAs 13 and 21 will reverse back in the following days.

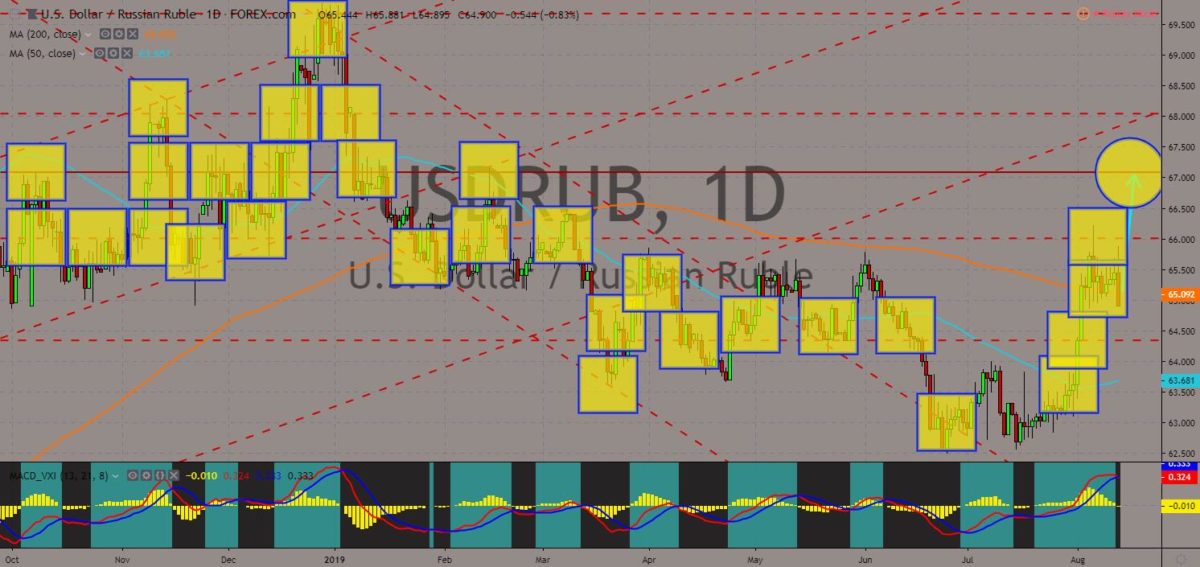

USDRUB

The pair was expected to move higher in the following days after it found a strong support line from 200 MA. Tensions are growing after Russia tested a nuclear weapon, something that was prohibited from now dissolved 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces Treaty. The withdrawal of the United States and Russia threatens another nuclear arms race. Aside from this, cooperation between another U.S. enemies, China and Iran, is growing, which will divide the U.S. efforts as it tries to secure its position in Europe, Asia, and in the Middle East. Russia and China is also ditching the U.S. Dollar, which was an ace for the U.S. All international transactions are being done in the U.S. Dollar after currency was linked to gold decades ago, putting the United States at the top. Histogram and EMAs 13 and 21 will reverse back after they crossed over.

COMMENTS