Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURCZK

The pair is seen trading upwards from its lows and above a key support level, fueling expectations from traders of a continued upward movement. The Czech krona was under pressure as the country’s central bank insists that the economy warrants higher interest rates. Domestic prices pressures outweigh the impacts of the perceived global economic slowdown. According to one central banker, it is optimistic that the country can endure a souring future abroad that has compelled world’s major central banks to adopt a more dovish tone. The CZK still retains its chronic weakness, however, even as a string of interest rate hikes have already been implemented before. Meanwhile, on the euro side, the European Central just gained the ire of the POTUS after ECB Chairman Mario Draghi indicated that either interest rate cuts or monetary easing could be an option for the bank soon if inflation target remains elusive.

USDHUF

The pair is poised to creep more upwards the chart, with prices sticking closely to the 50-day moving average line after confirming the golden cross hit in April. The price has dipped low early this month and converged with the 200-day moving average, but it’s now on track to recovery. On the HUF side, Hungary topped the European Union’s expectations as the country’s economic output rose more than expected, according to the country’s Finance Minister Mihaly Varga during a meeting of EU finance ministers last Friday in Luxemburg. The EU, according to Varga, estimated a growth 3.7% this year, but the government’s growth target was at 4.1%. Varga further added that the country’s 2020 budget bill will still offer a predictable environment for economic players. The target for annual economic growth is 4% and a budget deficit of just 1% of GDP. Public debt will continue to slide next year.

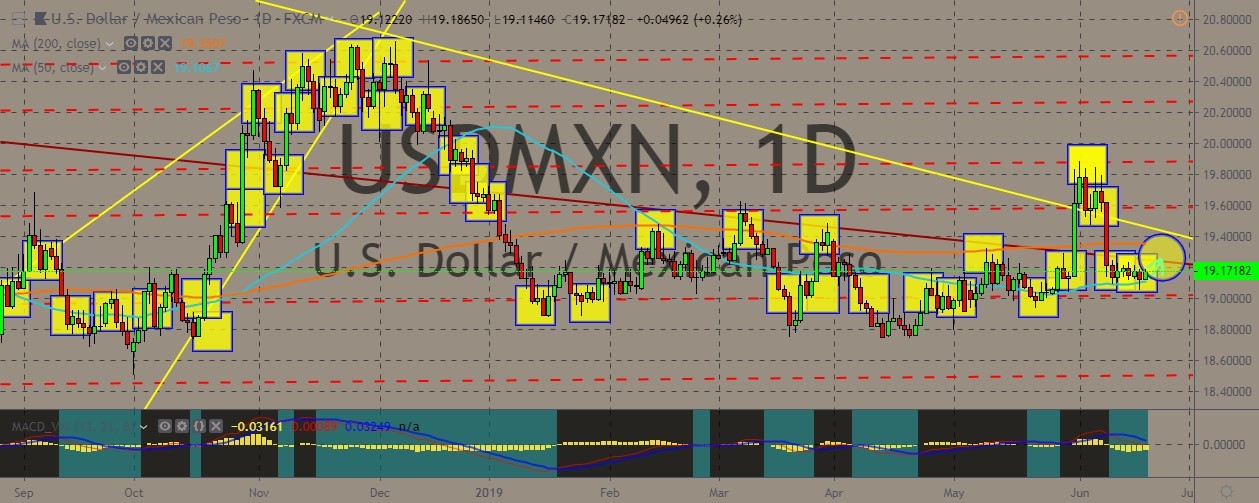

USDMXN

The pair is still trading in a tight range, testing the lower band as the Mexican peso weakened broadly in the American session in spite of the rise in risk appetite and rising crude prices. The ECB’s announcement of dovish ideas boosted stocks, which rallied after Mario Draghi’s remarks. The dollar, meanwhile, continued to be slightly muffled against LatAm currencies, including the Mexican peso. The pair on the chart hovers just above the 50-day moving average, close to converging. Meanwhile, on the trade war scene, Mexican President Andres Manuel Lopez said that Mexico could win a trade war with the United States, but the country wouldn’t take it for the heavy toll they may pay. Mexico made a deal with the US earlier this month over immigration policies enforcement, and the Mexican president said that the deal was positive because it got rid of the POTUS’ threat of across-the-board tariffs.

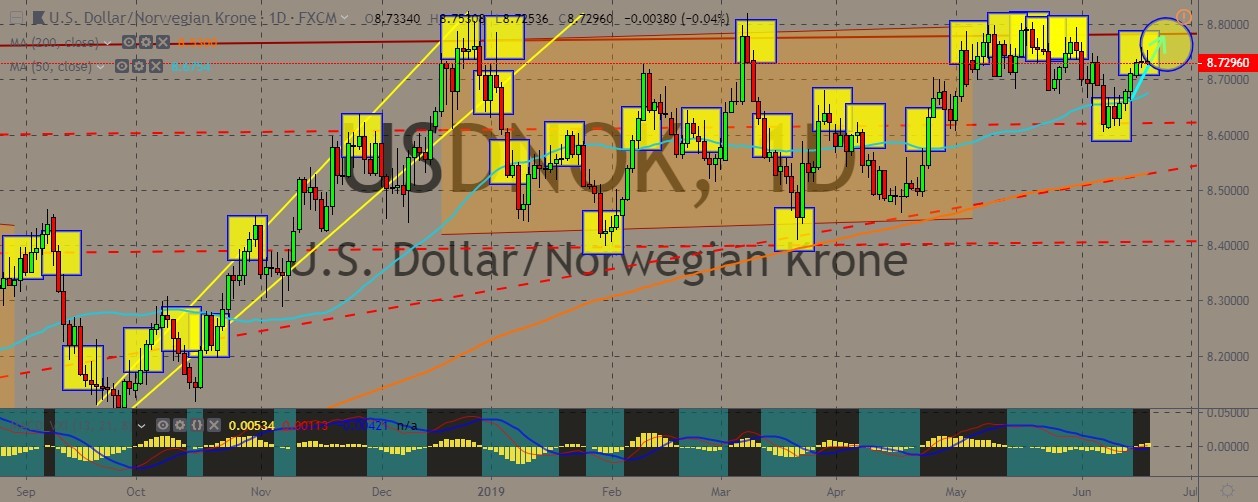

USDNOK

The USDNOK pair is currently at a standoff against a key resistance level, breaking a recovery from a recent dip. 50- and 200-day moving averages, however, point to a continued upward trajectory. The Norwegian krone remains inherently weak, but it also continues to help exporters and low unemployment is also helping to boost the income. Oil prices still remain above breakeven levels, and this supports investment. The krone has relatively become weaker due to global trade tensions and the slowdown in European growth, although the country’s outlook remains positive. The country’s central bank said it is poised to increase interest rates as mainland growth prospects are perceived to be accelerating. The bank’s current goal is to balance the slowly overheating economy and handle the elevated level of international risks due to trade tensions.

COMMENTS